Marlene Boersch, Mercantile Consulting Venture Inc.

July 2023

Statistics Canada (StatCan) has published their estimates of principal field crop areas for the 2023 year. This report can occasionally bring some surprises compared to the StatCan preliminary acreage report in April, and while the pea numbers are mostly as expected, the lentil numbers did surprise many in the trade.

Peas

For peas, the StatCan acreage intentions report in the spring projected acres to have dropped by 4.6% from last year to 3.2 million (M) acres this spring. However, given feedback from farmers, the sluggish market environment for peas leading up to seeding, and the relatively low forward prices for pea production contracts prior to seeding, this made little sense to us. Indeed, the Mercantile estimate of pea acres was (and is) for a full 10% reduction in acres from 2022 to just over 3 M acres in 2023. This StatCan seeded acreage report aligned with that opinion and estimated pea acres at 3.04 M acres, down 9.7% from last year. For comparison, a trade survey on 2023 pea acres showed an acreage estimate range of 3.0 to 3.5 M acres, with an average estimate of 3.2 M acres.

We think the 3 M acre number makes sense, as it seems to be a logical response by farmers to the market signals given in the pea markets over the past several years:

- Unusual volatility of demand because of the withdrawal of India from the pea markets (2018/19) and by unreliable demand from the Chinese feed sector.

- Dangerous dependence on China as the single most important buyer (China comprised 66% of Canada’s 2021/22 pea exports and 56% in 2022/23 year-to-date (YTD). YTD exports to India are a negligible 1,444 tonnes).

- Increased competition by Eastern European producers, especially by Russia, and the attendant threat of a potentially significant market share loss into China.

In addition to the above market factors, root rot and disease pressure has also been an increasingly serious problem for pea growers.

What has remained in place is increasing North American demand for peas in the pet food sector and the growing, albeit more slowly than expected, demand in pea fractioning. The growth in domestic markets is a very healthy development in that it makes producers less dependent on volatile export markets. However, it has not been big enough to compensate for volume losses in the dominant pea markets in India and China.

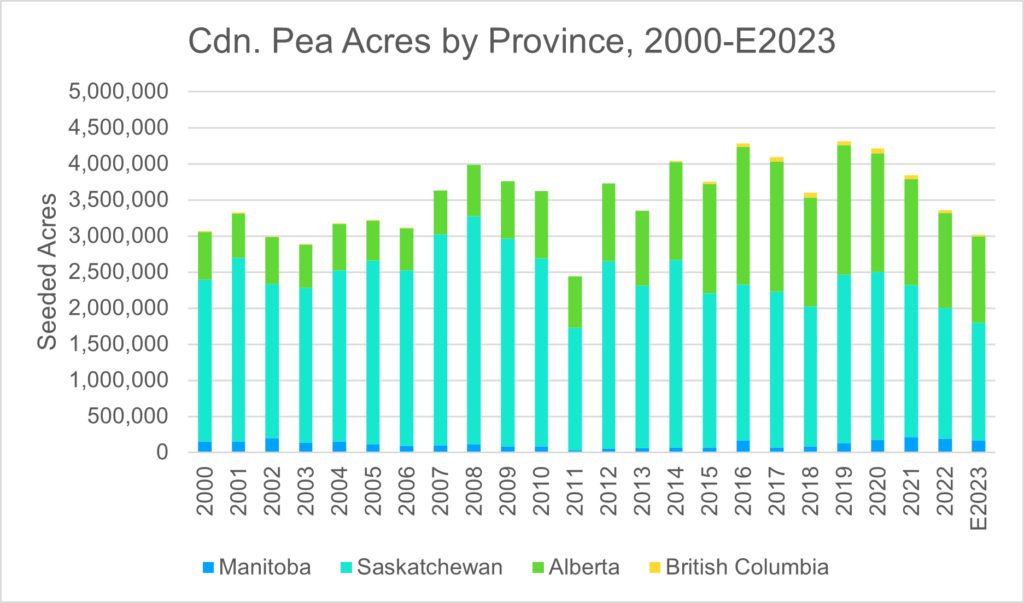

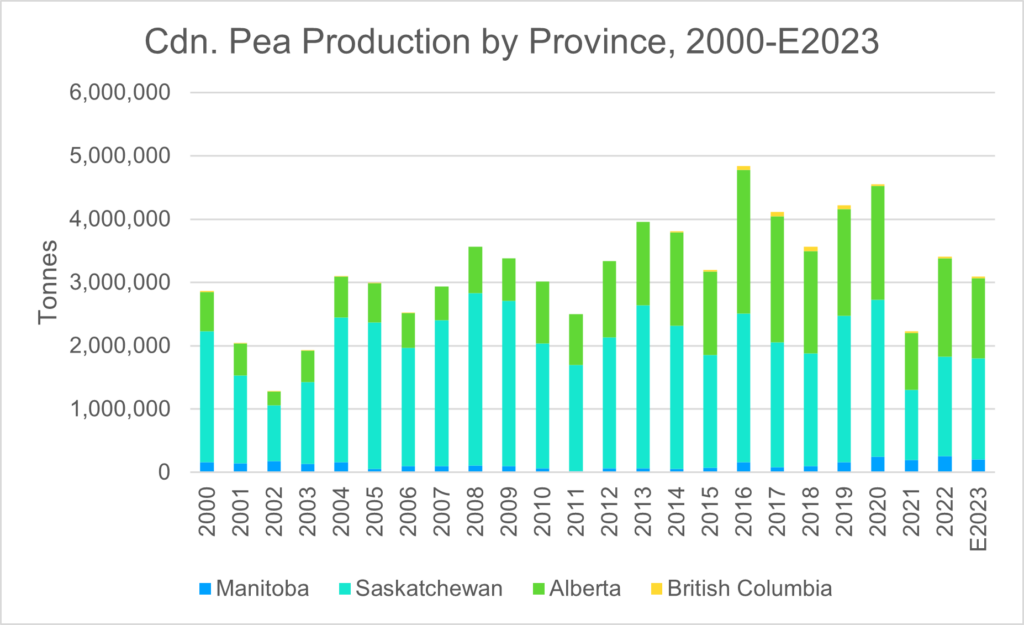

Indeed, a review of seeded pea acres over the past 23 years shows that, supported by energetic bulk shipments, acres generally trended up into 2019 but have dropped by a full 30%from 4.3 M acres to just over 3 M acres since then.

To put our peas into the international context, Canadian peas should still comprise about 25% of global pea production this year (among the major producers), but in past years the Canadian share has been as high as 30%. Canadian pea exports thrive on bulk shipments to the big buyers, with bulk shipments comprising up to 70% exports. Peas then lose attraction for many growers once the demand-pull of the bulk shipments wanes, especially in Alberta where the biggest growth in acres occurred over the past ten years.

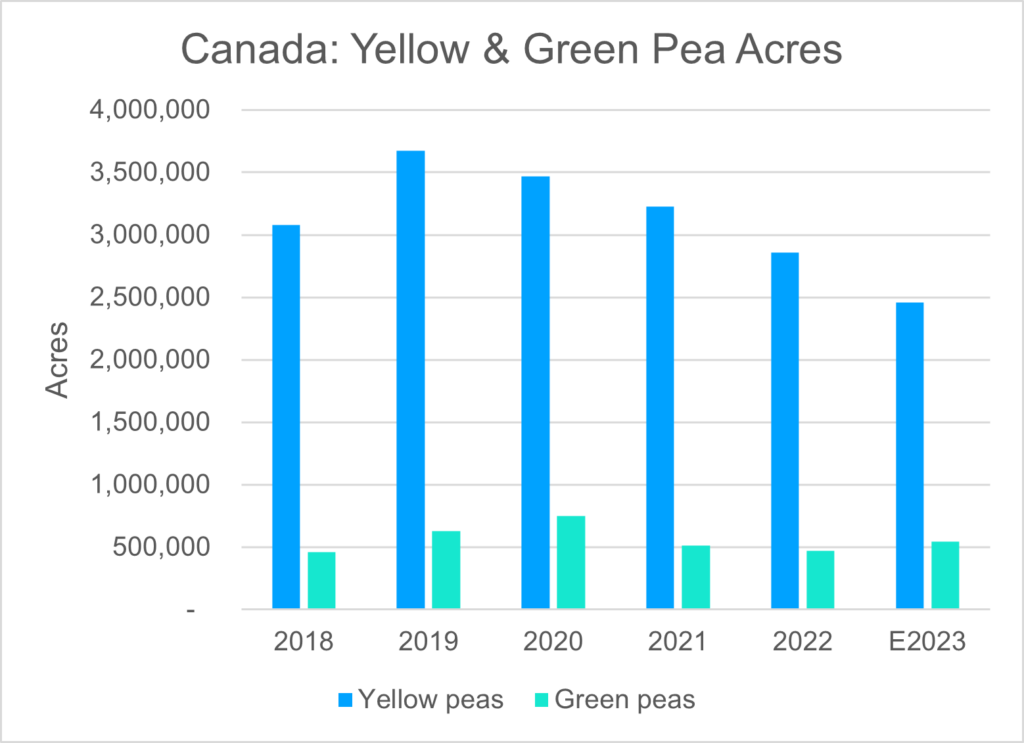

Aside from the significant drop in overall pea acreage, there has also been a shift in the yellow-green pea acreage distribution that warrants attention. Yellow pea acres have deceased since 2019, with this year’s yellow pea acreage reduction at an estimated 14% to ~2.46 M acres. In contrast, green pea acres have increased by an estimated 15% this year to well above the 500 thousand (K) acreage mark to ~545 K acres. Again, this switch was supported by solid, steady demand for green peas by Chinese buyers, while they were ignoring yellow pea offers for the feed sector.

Given the latest acreage scenario, we expect total pea production at ~2.94 M tonnes, about 15% lower than last year’s, and supply at 3.56 M tonnes, ~4% below last year’s. The crop condition reports in Saskatchewan have been mostly favourable so far, but there is concern about peas in Central Alberta due to significant precipitation deficits. Problems in Alberta could affect production volumes significantly, as the province has close to 40% of total pea acres this year. This could be a big threat to overall production volumes.

Still, given an average crop, there should be no problem servicing the existing export and domestic markets in the new crop year.

Lentils

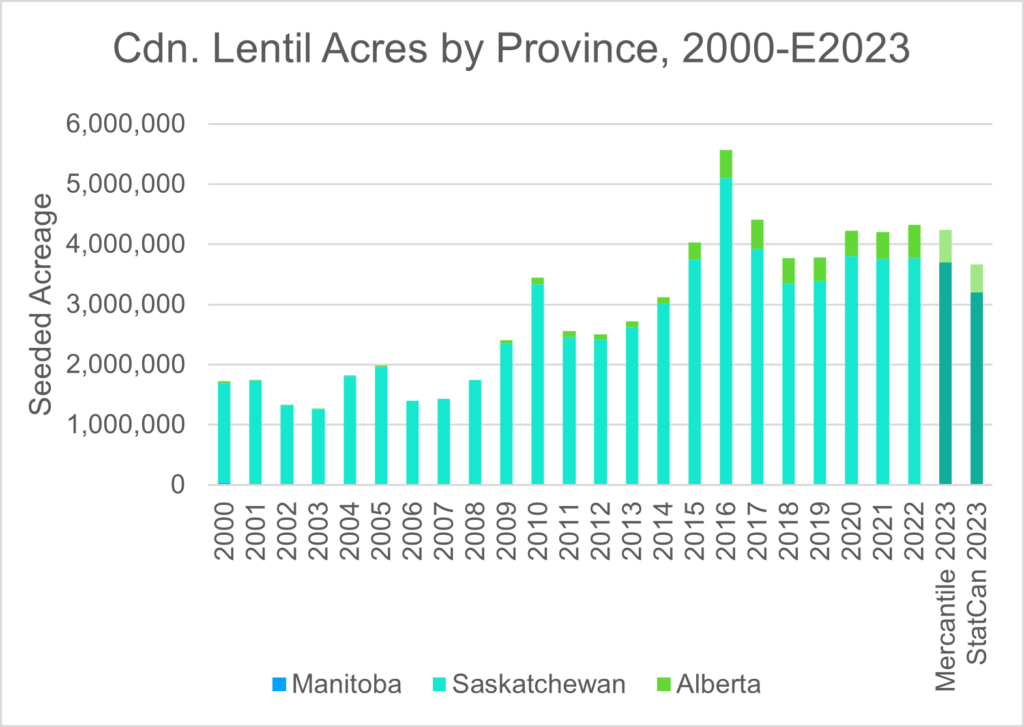

Turning to lentil acres, the matter of seeded acres gets a lot more controversial. We think that lentil acres have been much more stable at a higher level after correcting for the very high acres in 2016. However, already in their acreage intentions report, Statistics Canada assessed 2023 lentil acres 8% lower than the 2022 acreage. Mercantile deduced that this was questionable and expected acres to remain close to last year’s at ~4.2 M acres despite the increasing disease pressure. However, in their June report StanCan maintained the notion that Canadian lentil acres have fallen substantially, and even increased the reduction materially to 15.1% or 3.669 M acres. If correct, this will matter to a market where carry-in stocks are already small. It also makes the market even more sensitive to adverse weather effects than it was before.

We still find the size of the drop in lentil acres difficult to rationalize when considering the recent markets underpinning lentil production:

- Demand for all types of lentils has been very steady over the winter, spring and into summer.

- Prices for both current crop and importantly new crop lentils were relatively high and increasing into the spring.

- Competition by Australian lentils has been strong but did not dilute prices.

We do agree that disease pressure has increased and that perhaps processors and exporters reacted too slowly this spring to raise prices for red lentil production contracts in response to unusually strong bulk lentil shipments (~1.2 M tonnes YTD), which provided the demand-pull dynamics that have been lacking in the pea markets.

It is important to emphasize that the demand portfolio for lentils is much more diversified than that for peas. First, Canada has two (not one) dominant buyers of lentils: India and Turkey (22% and 29% market share respectively YTD 2022/23), and we note that as of April, 2022/23 lentil imports by Turkey exceed those by India by 112 K tonnes. There are also several medium-sized buyers, like the UAE, Bangladesh, and the United States (US), as well as other important buyers for both red and green lentil types (Pakistan, Colombia, and Algeria).

On the supply side, there are only two major exporters for green lentils: Canada and the US. With limited supplies by both exporters, green lentil prices have been especially strong, with decent bids going into seeding and with up to $65 per hundredweight being paid recently for large greens. Even given the overall reduction in acres, we think that that the green lentil acreage this year could well be close to 900 K acres this year (~770 K acres last year), and small greens might be back to 385 K acres (314 K acres last year). This would leave red lentil acres down at 2.34 M acres (3.2 M last year), a serious 26% reduction. If this turns out to be correct, then red lentils will likely become tight internationally.

For red lentils, our main competition will be Australian lentils. Lentil acres in Australia are up again from last year, and some traders think that the 2023 Australian lentil crop may again surpass 1 M tonnes this year. This could cushion the potential reduction in Canadian supplies, although we have also seen unusually deep demand for lentils, which has kept pace with the red lentil production increases in Australia.

Using the StatCan estimate of only 3.67 M acres against an average yield of 1,250 pounds per acre has Canadian lentil production fall by almost 10% to 2.1 M tonnes and supply by 13% to 2.26 M tonnes (due to the low carry-in). Contrary to other crops, global ending stocks of lentils are small, which is why buyers are watching growing conditions in Canada, Australia, and India very carefully. The general lack of carryover stocks leaves little room for production losses. So, if both Canadian crops, Australian crops, and US lentils do well, the problem is contained but tight enough for prices to remain firm. But if one of the two majors’ falters, then there still is room for prices to move up.

Marlene Boersch is a managing partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.