By Marlene Boersch, Mercantile Consulting Venture Inc

January 2024

At the time of writing (December 20, 2023) we are almost five months into the 2023/24 crop year, so this is a good time to review the 2023 production outcome and demand developments since harvest.

We just received the final Statistics Canada (StanCan) production numbers a couple of weeks ago, and while they were radically different from their September estimates, they were much closer to the estimates held by the trade and analysts. For peas, StatCan increased their earlier numbers by an incredible 15% to 2.6 million tonnes, where normally one would expect an adjustment of a few percentage points from one report to the next. This boosted the Canadian pea supply by 337,000 tonnes to 3.15 million tonnes, which still is about 650,000 tonnes (-17%) smaller than last year’s supply. In isolation this might prompt the idea that the pea balance sheet is significantly tighter this year than last year’s, but we must revisit two additional major influences before drawing conclusions. First, on the supply side, what was the pea production outcome by our major competitors? And second, are there any major changes or developments on the demand side?

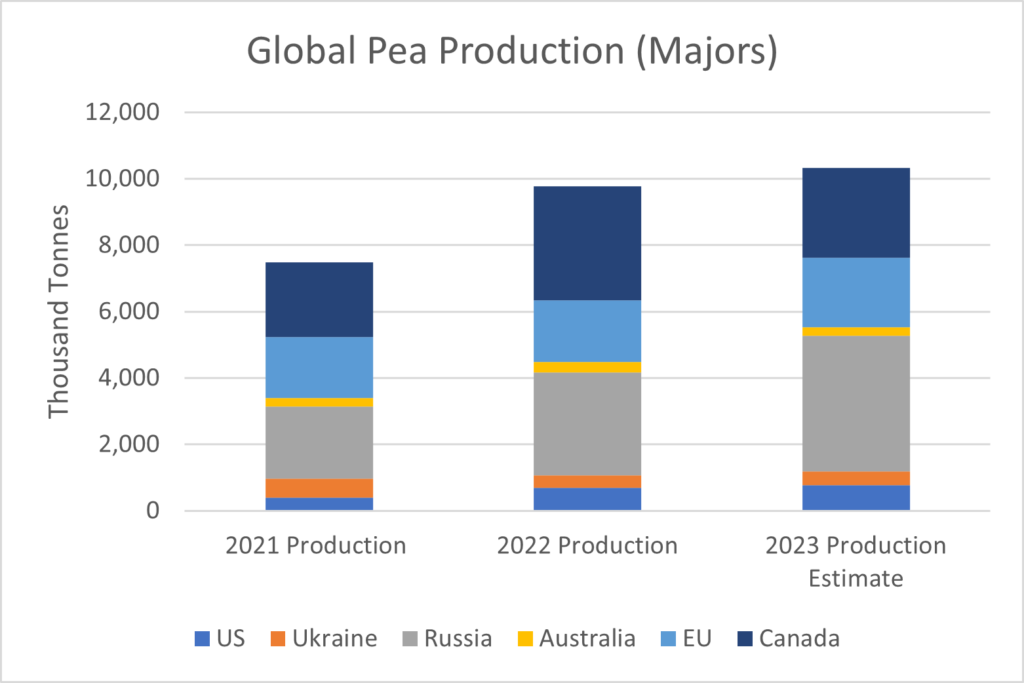

On the supply side, by far the biggest change in production among the major producers occurred in Russia, where production increased by another 1 million tonnes to an estimated 4.1 million tonnes (+32%). This is boosting the 2023 overall pea production by the major producers to about 10.3 million tonnes from 9.8 million tonnes the year prior (+6%). In other words, despite of the downturn in Canadian production this year, global pea production is up, not down.

Paired with the fact that Russia gained phytosanitary approval to send peas to China last crop year, the high production in Russia has introduced a new, potentially formidable competitor into the Chinese pea markets. In fact, a review of market share data shows that the Canadian market share in China’s pea markets has dropped from 93.1% in 2020 to 70.4% in 2023 (January to September), while Russia’s market share has risen from 0% in 2020 to 22% in 2023 (January to September).

So, given the new Russian competition and comments to us by buyers in China, we allocated Canadian yellow peas to the Chinese fractioning market, but none to lower quality or feed markets. We also expect Canada being able to maintain the important green pea markets into China as Russia produces yellow peas. Given these specifics, and the continued closure of the Indian pea market, we used a 2.1 million tonne total export potential for Canadian peas for 2023/24.

Meanwhile, on December 7, India reversed course in its pea import policies and removed all import restrictions on peas for the period of December 8, 2023 to March 31, 2024. This is the first time in about six years that India has completely opened pea imports, albeit for a limited window. This change should give Canadian exporters the opportunity to export anywhere from 200,000–300,000 tonnes of additional yellow peas that were not included in the earlier export projections. There will be competition into India by peas from Russia, but yellow pea prices in Canada quickly appreciated to $13.00-13.50 per bushel (/bu) in Saskatchewan (up to $14/bu in Alberta) as exporters are trying to take advantage of the window into India. All else held equal (i.e., given that China will continue to import their peas for fractionation from Canada at slightly higher values, and given there will be no United States (US) antidumping and countervailing duties on Chinese pea protein), additional pea exports of 200,000–300,000 tonnes to India would tighten the Canadian pea balance sheet from a 7% stock-use ratio to a much tighter 2% stock-use ratio.

In other words, green peas and maple peas will remain tight, and the yellow pea market has the potential to become reasonably tight, but still is subject to several political and potentially disruptive influences. We think the yellow pea producers who took advantage of the price spike to fit yellow peas into the export window to India acted prudently.

Another consideration towards spring is the need for peas to compete for acres with other crops to prevent a further decline in its acreage base in 2024. Current new crop bids for green peas at $12/bul will attract acres, but new crop yellow pea bids at approximately $8–9/bu might not be enough to maintain acres, especially given the challenges with root rot in most areas. We expect forward prices for yellow peas to become an issue towards spring.

The StatCan production number on lentils also underwent a major revision in the December report. Canadian lentil production was raised by 129,000 tonnes (+8.4%) in December to 1.7 million tonnes. Again, this is closer to reflecting the trade’s production estimates, but still is 27% smaller than the 2022 lentil production. And using the StatsCan number, lentil supply at 1.9 million tonnes is also approximately 27% smaller than last year’s. Furthermore, we calculate that global lentil production by the major producers at 5.5 million tonnes is down by about 10% from the previous year. So, this is very different from the pea scenario, where the shortfall in Canada was more than offset by other producers.

Having said that, we do note that this year’s red lentil production in Australia at 1.4 million tonnes was bigger than expected and did mute red lentil prices somewhat during November and December. India has been receiving bulk lentil shipments from both Canada and Australia this fall, so that the lentil market there is well supplied for now.

However, we are concerned that Canada has also been losing market share in the important lentil markets in India and in Turkey, partly due to the smaller crops in Canada, but also due to increased competition by Australia, Russia, and Kazakhstan. Specifically in India, Canadian lentils held an 82% market share in 2020, but this dropped to 43% in 2023 (January to June), while the market share of Australian lentils rose from 12% in 2020 to 56% in 2023 (January to June). In Turkey, Canadian lentils held an 82% market share in 2020, but this dropped to 67% in 2023 (January to June), while the market share of Russian & Kazakh lentils combined rose from 13% in 2020 to 22% in 2023 (January to June).

Nevertheless, prices for lentils have remained quite firm because the overall global supply of lentils is much tighter than that of peas, and global demand has been unusually strong. We believe that the spread between global supply and demand for lentils has tightened for the past three years, despite increases in supply with three very good crops in Australia. What happens to the red lentil prices in the New Year, will largely depend on the depth of demand from India, the single biggest buyer. Green lentils will remain firm until we are basically out of product. We expect the spread between green and red lentils to tighten somewhat towards seeding to attract red lentil acres.

The market for green lentils has been especially tight and this has resulted in historically high values for green lentils. Basically, only Canada and the US export green lentils, and the 2023 combined green lentil production is down to about 815,000 tonnes, against an estimated green lentil import demand this year of roughly 815,000 tonnes. This is without accounting for domestic requirements, like seed. Unlike the markets for reds, the green lentil markets have not increased significantly, but acres have dropped over time in favour of red lentils due to yield advantages and the better liquidity in red lentil markets. This year, the green lentil market is trying to entice green lentil acres by showing historically high prices for current and for new crop. With only Canada and the US in the running, returns to greens should remain good into next crop year.

Marlene Boersch is a managing partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.