By Marlene Boersch, Mercantile Consulting Venture Inc.

February 4, 2020

We are about halfway through the 2019/20 crop year, so this is a good time to review how the crop year is evolving for marketing. Frustratingly, we at Mercantile Consulting Venture Inc. have not yet received the

Statistics Canada numbers for December exports by destination, so we are using overall Canadian Grain Commission (CGC) numbers to get a handle on export performance.

Peas

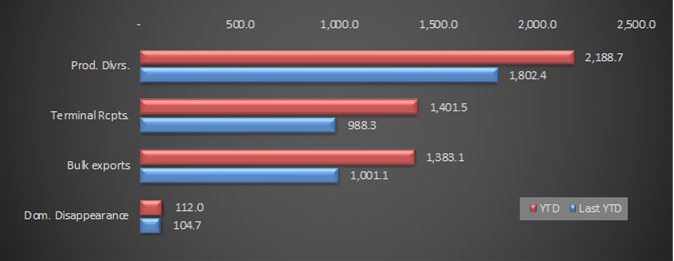

Pea shipments have been smooth this year and early shipment volumes benefitted from the fact that peas were off before the harvest of most other crops which were delayed by rain. Bulk export shipments as shown by CGC as of shipping week 25 reached 1.38 million (M) tonnes, and exceed last year’s by 382,000 tonnes (an increase of 38%). The CGC report does not fully capture container shipments, which we estimate at about 135,000 tonnes per month. This suggests that about 2.3 M tonnes of peas will have been exported over the first six months of the crop year, compared to 1.6 M tonnes last year to the end of January 2019.

The biggest gains over last year were made to China, which has taken 1 M tonnes of Canadian peas to the end of November. The previous year China took 790,000 tonnes to the end of November. This development is also a worry. China has taken 73% of all Canadian pea exports to the end of November, so the market remains very concentrated. China has essentially replaced India as the dominant buyer.

The above numbers help us determine how many peas are left available in Canada for the export market for the second half of the crop year. We calculate a 2019/20 initial pea supply of just below 4.7 M tonnes, and subtracting export shipments and about 400,000 tonnes for year-to-date (YTD) domestic use, tells us that just under 2 M tonnes of peas are left to account for export and domestic demand during the second half of the crop year plus and ending stocks. Assuming 260,000 tonnes of ending stocks and another roughly 400,000 tonnes of domestic demand (including seed), this leaves 1.3 M tonnes available for export. This is reasonably tight, given there is no disruption in our markets. For example, last year, we shipped 1.7 M tonnes of peas during the period of February through to July 2019.

This does not necessarily lead to higher grower prices, but it shows the market is getting tighter and normally should insulate prices from deteriorating. One of the issues currently diluting the effect of fairly tight supplies is the fact that major commodity prices (soybeans and wheat) have been falling hard following a (so far) ineffectual Phase 1 US-China agreement. The potential effects of African Swine Fever and the coronavirus in China have also dampened demand expectations, and this sentiment is spilling over into special crops, especially since China is the main buyer. In fact, at the time of writing yellow pea prices have fallen back below $7.00 per bushel (bu) in Saskatchewan.

China is our single biggest risk at this time. If China does decide to comply with Phase 1 imports of the US-China agreement, then our exports will not remain unchanged from expectations, but will be down. In fact, should the US-China agreement be adhered to, then we could see exports to China for the second half of the crop year fall by 50% from expectations, thus adding to ending stocks. This would turn the balance sheet much more bearish than if there are no changes to China.

This risk, in turn, needs to be considered when thinking about new crop acres. If China reduces their buying then we should respond by reducing pea acres, or we will again start to accumulate ending stocks. To reduce the price risk, we would be selling peas near $6.75-7/bu right now, and lower new crop acres. We do note that Eastern European pea acreage has been dropping, which is affording less competition than was seen last year and the year before. We do not expect Eastern European acres to recover this year, but we still need our major buyers to be in the markets.

Table 1. Canadian Grain Commission Pea Handling Summary: YTD 2019/20 vs Last YTD 2018/19 (to Week 25, ‘000 Tonnes)

Lentils

Canada has been exporting about 170,000 tonnes of lentils per month this crop year, and we expect this pace to continue or slightly increase due to the smaller than anticipated Australian crop. Exports to the end of January should reach about 1 M tonnes of a projected 2.02 M tonnes for the whole crop year.

India has been Canada’s most prolific lentil buyer, followed by Turkey. Importantly, Canada has regained market share in Turkey because of the much smaller lentil crop from Kazakhstan, which has been competing with Canadian lentils into that destination.

To gauge relative tightness of lentil supply for the second half of the crop year, we again use the YTD export number to help us determine how many lentils are left for export purposes for the remainder of the crop year. We calculate a 2019/20 lentil supply of 2.76 M tonnes, and subtracting export shipments and about 200,000 tonnes for YTD domestic use, tells us that roughly 1.56 M tonnes of lentils are left to account for export and domestic demand during the second half of the crop year plus and ending stocks.

Assuming 340,000 tonnes of expected ending stocks and another 200,000 tonnes of expected domestic demand (including seed), this leaves 1 M tonnes available for export for the remainder of the crop year. Last year, we exported 1.1 M tonnes of lentils during the second half of the year.

Lentils are less tight than peas without a China problem, but similar to peas, there are not a lot of other origins with significant volumes left. Still, the general market sentiment has turned more negative after the US-China Phase 1 deal and the coronavirus. Lentil exports are not reliant on China and the market should be tight enough to at least hold prices.

For new crop lentils, we are expecting an approximately 5% increase in acres for next year. If correct, and given average yields, this would keep next year’s expected ending stocks at 300,000 tonnes, so stocks keep falling somewhat and there is no longer a really burdensome carry-in to start the year, or cushion production problems around the world.

Marlene Boersch is an operating partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.

Table 2. Kazakhstan Estimated Lentil Production, 1992-E2019