By Chuck Penner, LeftField Commodity Research

March 2021

With all of the hubbub in markets like canola and barley, other crops like pulses are not getting quite the same attention. Even among pulses, some of the smaller acreage crops are not feeling much love at all. One reason for the lack of attention is that pulses like faba beans, chickpeas, and dry beans have not been rallying the same way as other crops. This flying under the radar could be beneficial and end up providing opportunities.

Chickpeas

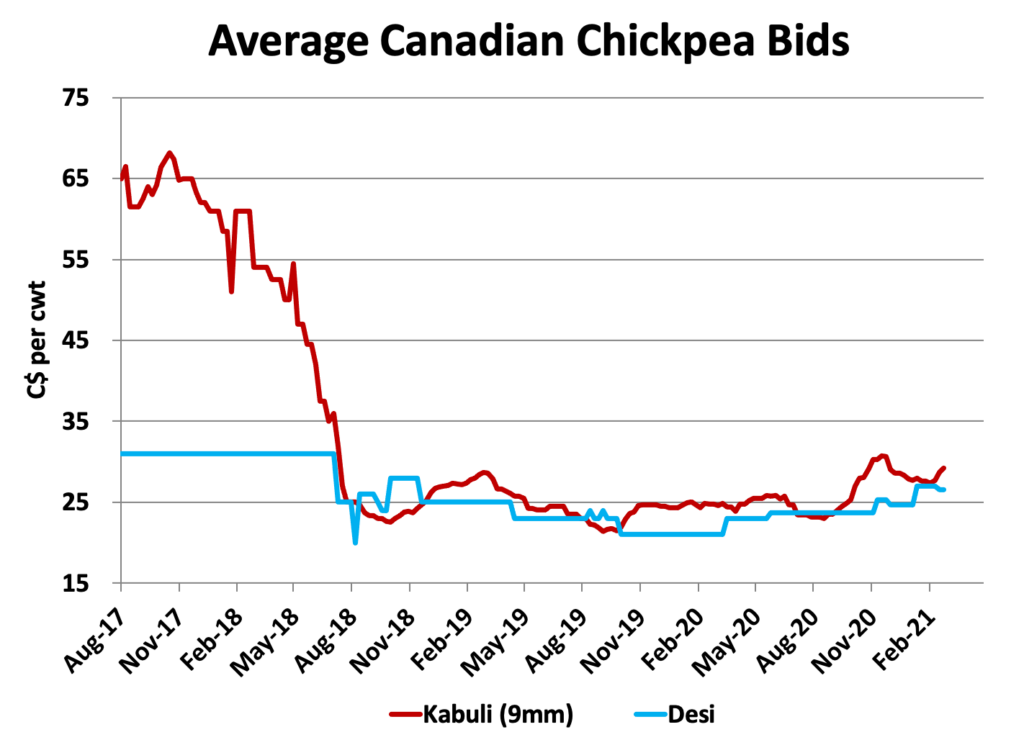

Chickpea prices in Western Canada have been more or less stagnant for the last couple of years, with prices staying in a fairly narrow range since the extreme highs of 2017/18. True, there was a bit of strength last fall, but it did not last long.

Source: LeftField Commodity Research

The main reason for the flat price environment is the large supply of Canadian and United States (U.S.) chickpeas. There has been much debate in the trade regarding the actual size of on-farm inventories, with doubts about Statistics Canada’s (StatCan) skyhigh stocks estimate, but there is no question supplies are large. Even with a 24% drop in the 2020 crop, StatCan is reporting supplies for 2020/21 at nearly 500,000 tonnes. That number may be disputed, but it is hard to argue that supplies are, in any way, shape, or form, tight.

One of the main supports keeping Kabuli prices from dropping further is farmers’ reluctance to sell at prices much below 30 cents per pound. Frankly, one of the best things that could happen to North American chickpea prices is that these low prices convince most farmers to avoid the crop in 2021 and let stockpiles work their way down. That fits the old saying “the best cure for low prices is low prices”. Ultimately, this would benefit those holding onto chickpea supplies and those contrarians who still choose to grow chickpeas, even with low prices and disease concerns.

Faba Beans

Faba bean markets have also been not much to look at this year, especially compared to the strength in other pulses. That said, there are friendlier influences that are providing some room for optimism. In contrast to chickpeas, any heaviness affecting faba beans did not come from oversupplies in Canada. StatCan did peg the 2020 faba bean crop at 125,000 tonnes, up 15% from last year, but that is certainly not a large crop by any means.

The bigger issue for faba beans is that most other key producing countries boosted their production as well. The largest gains were seen in Australia where the 2020/21 crop ended up at a new record of 510,000 tonnes and 56% more than the previous year. Most observers expect the actual crop size was even larger. Australia has been the dominant exporter in years past but crop problems there had allowed Canada to make inroads into the Egyptian market. That has become a lot more challenging again with an Australian crop at least four times the size of Canada’s.

Source: LeftField Commodity Research

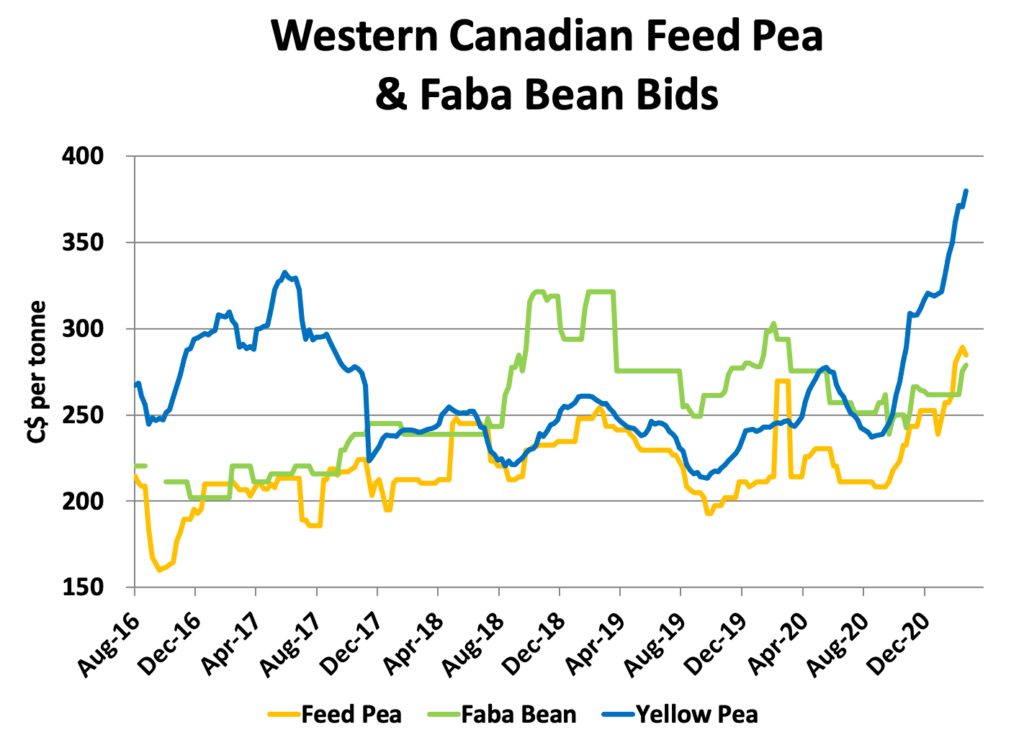

Despite the bigger crops in Canada, Australia, and Western Europe, faba bean prices have not suffered too badly. The main support now is coming from the feed market. For those who have not noticed, prices of almost any feed ingredient under the sun have rallied sharply.

Protein sources in particular have benefited, including peas and faba beans. Even so, the faba bean market has not been able to follow at the same pace. That is partly because faba beans are still not well integrated into Canada’s feed markets. Also note that the price shown in the chart is a combination of all types of faba beans, and not all work well in feed rations.

The positive news for faba beans is that the bigger Canadian and global crops have not depressed prices and there is more upside potential. Ultimately though, the Canadian faba bean market needs more domestic processing for both food and feed. Steps are being taken in that direction and those are being helped by new varieties that allow higher value products.

Dry Beans

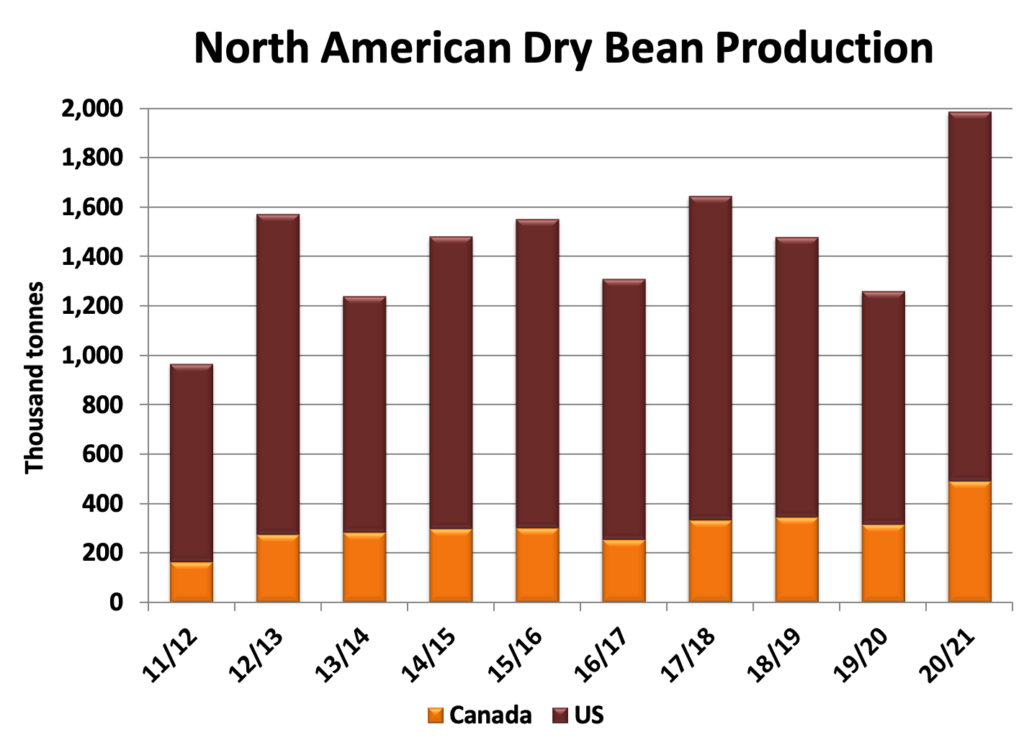

Earlier this year, it looked like the dry bean market was going to get swamped by a huge increase in 2020 crops in Canada and the U.S. Not only did production increase 55% in Canada and 58% in the U.S. over last year’s small crop, dry bean production was near record levels in both countries, which should have caused the bottom to drop out of the market.

Source: Statistics Canada, United States Department of Agriculture

While it is true that there was a sharp shift from the extreme highs in 2019/20, bids have been firming up ever since. Most of that strength has come from very heavy export demand. Early on, overseas buyers were simply trying to restock their shelves but that strong export pace has continued.

Over the last three months, Canada has exported an average of 42,000 tonnes per month of dry beans and volumes are running at a record pace. Larger amounts have been moving to regular customers, with some additional business headed to Latin America, due to smaller crops there.

Looking ahead to the next marketing year, there is a good chance that high soybean prices will cause some farmers on the prairies and in Ontario to shift away from dry beans. If that is the case, it is setting up the potential for a smaller Canadian crop again in 2021. If prices are already firm with a near record 2020 crop, a drop-off in production should see an even more positive response.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.