By Marlene Boersch, Mercantile Consulting Venture Inc

January 2025

We are already five months into the 2024/25 crop year, so this is a good time to review the global production outcome and year-to-date demand developments to get a feel for the markets going into the second half of the crop year.

Peas

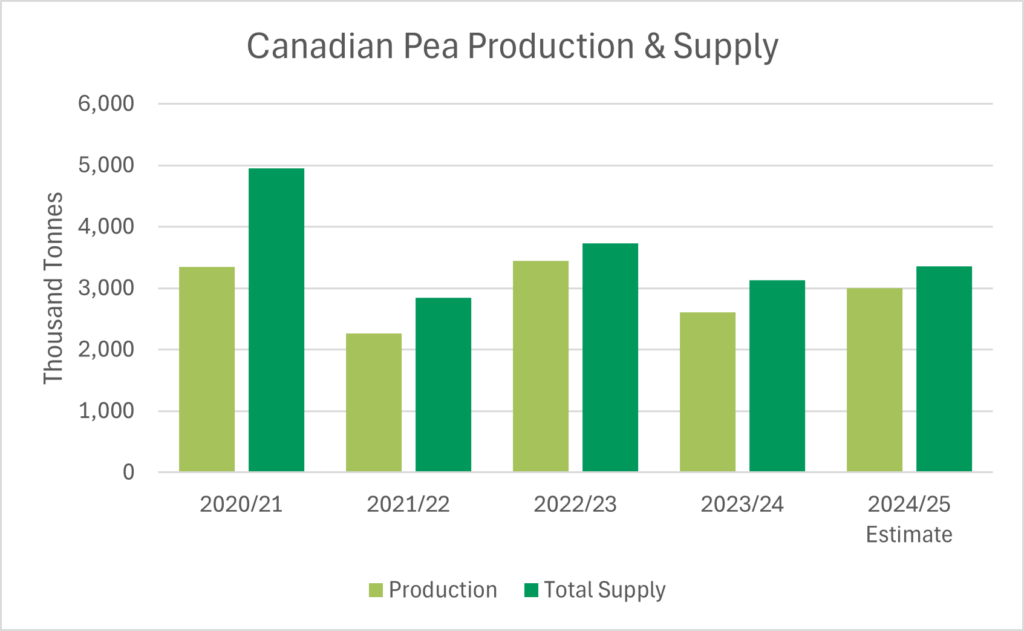

Starting with Canadian peas, we note that the “final” Statistics Canada (StatCan) production number for 2024 published in December showed a downward reduction of 163,000 tonnes to 2,997 tonnes from the earlier StatCan estimates. The final number represents a 15% increase in pea production from 2023 (on a 6% higher acreage), but this still is well below the 3.4 million tonnes produced in 2022. It also is a smaller production than anticipated earlier in the year by the trade. The resulting Canadian supply number (production plus carry-in) for 2024/25 is 7.4% higher than last year’s. So, we ended up with an increase in pea supply for this crop year, but it is not as big as expected. Also interestingly, while production numbers by type of pea are not cut in stone, we think that yellow pea production increased by a relatively modest 275,000 tonnes to around 2.5 million tonnes in 2025 with supply around 2.8 million tonnes, while green pea production increased significantly by about 130,000 tonnes to roughly 425,000 tonnes with supply at about 570,000 tonnes.

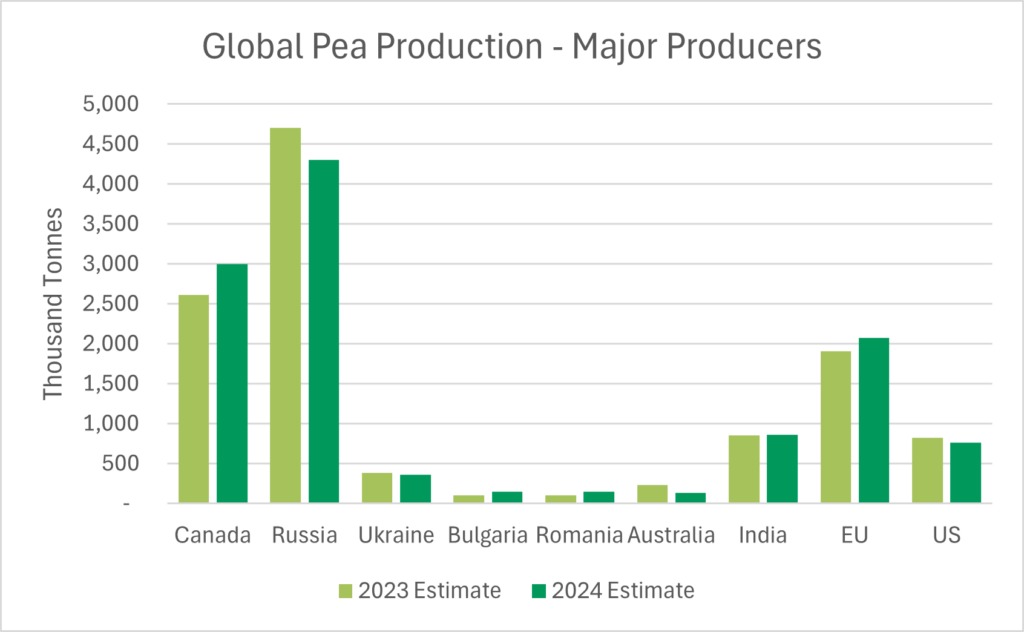

According to our numbers, global pea production did not change much from the previous year. We calculate the 2024 global production (major producers) at 11.78 million tonnes, up 1.8% from 11.7 million tonnes in 2023. As shown in the graph below, Russia and Canada are by far the most determinate pea producers, followed by the European Union (EU), India, and the United States (US). Production in Russia and in Australia dropped last year, while production in Canada and the EU increased.

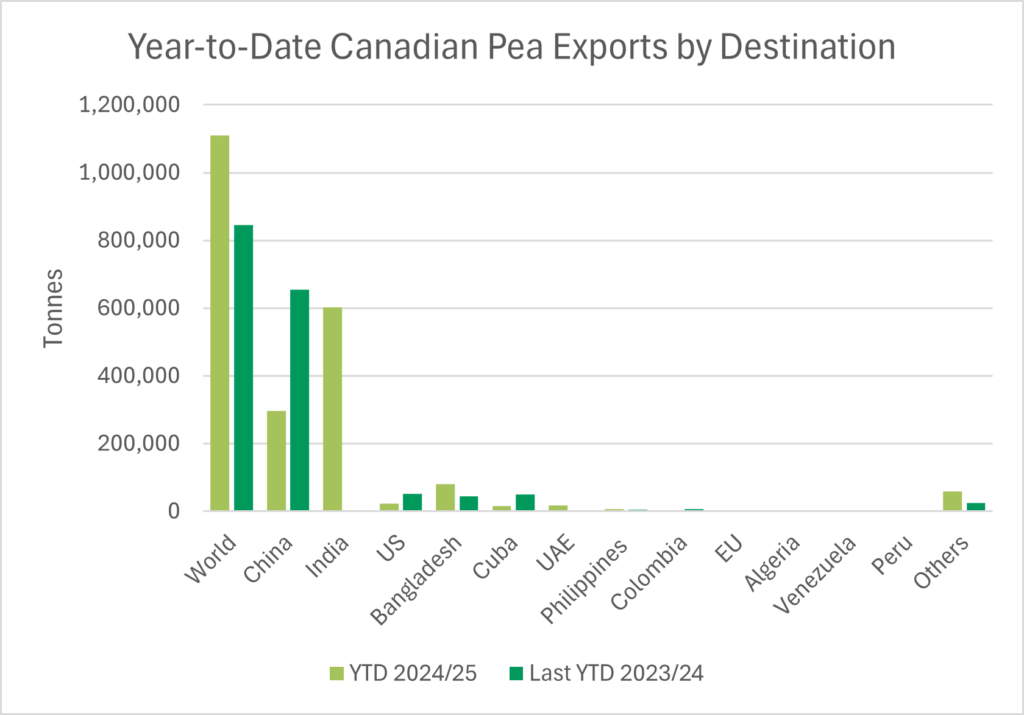

On the demand side of the equation, Canadian exports have been much more front-end loaded than in the previous year. This is mainly because Canada started the 2024/25 crop year without import restrictions by India, while India only opened up in December last crop year (2023). In fact, on Christmas Eve, the Indian Government extended the deadline for pea shipments to enter the country duty-free from December 31, 2024 to February 28, 2025. This is good news. Contacts in India say that approving an extension for peas as the cheapest pulse for India made sense to keep food inflation in India under control. For Canada, it means that yellow peas shipped with on board bills of lading dated on/before February 28 can enter the country duty-free.

We only have StatCan 2024/25 export data to the end of October, but this data shows that 602,000 tonnes of Canadian peas were shipped to India during August to October 2024, compared to 138 tonnes last year. In fact, Indian import data indicates that the country imported a big 2.5 million tonnes of peas from all origins from January 2024 to October 2025, including 850,000 tonnes from Russia. Will India continue to buy? We think the duty-free period was extended to keep all options open depending on domestic pulse production, but the pace of imports will drop until some of the imports have been fully absorbed by the domestic market.

The second determinant import destination is China. Imports of Canadian peas by China (August through October 2024) at 297,000 tonnes were down substantially from the previous year. This is not only because China imported fewer peas, but also because China has been diversifying their pea sourcing to include Russia, Kazakhstan, and others. To wit, Chinese customs data indicates that China imported 1.8 million tonnes of peas during January 2023 through October 2023, while only importing 1.1 million tonnes during January 2024 through October 2024, a 40% drop. We do note that China’s pea imports in October 2024 (last available numbers) were encouraging at 245,000 tonnes, of which 156,000 tonnes came from Canada and 73,000 tonnes from Russia. Basically, imports of peas for feed have slowed to a trickle (imports of most feed grains have slowed due to a smaller hog population, so competition for Chinese feed demand is heightened), while edible pea imports have definitely held their own, especially for green peas. We expect demand for edible peas by China to remain constant.

Regarding overseas values, we note that Russian peas into India are about $45/tonne cheaper than Canadian peas, though the quality is not the same, and most buyers seem to appreciate that fact. Values for green peas into China have appreciated a smidgeon.

Mercantile projects total Canadian pea exports at 2.36 million tonnes (2.4 million tonnes last crop year). This would leave just 1.3 million tonnes of Canadian peas to be exported for November 1 forward to July 31 2025 and would leave Canadian ending stocks at 365,000-400,000 tonnes, a 14% stock-use ratio. We expect pea values to remain stable.

Lentils

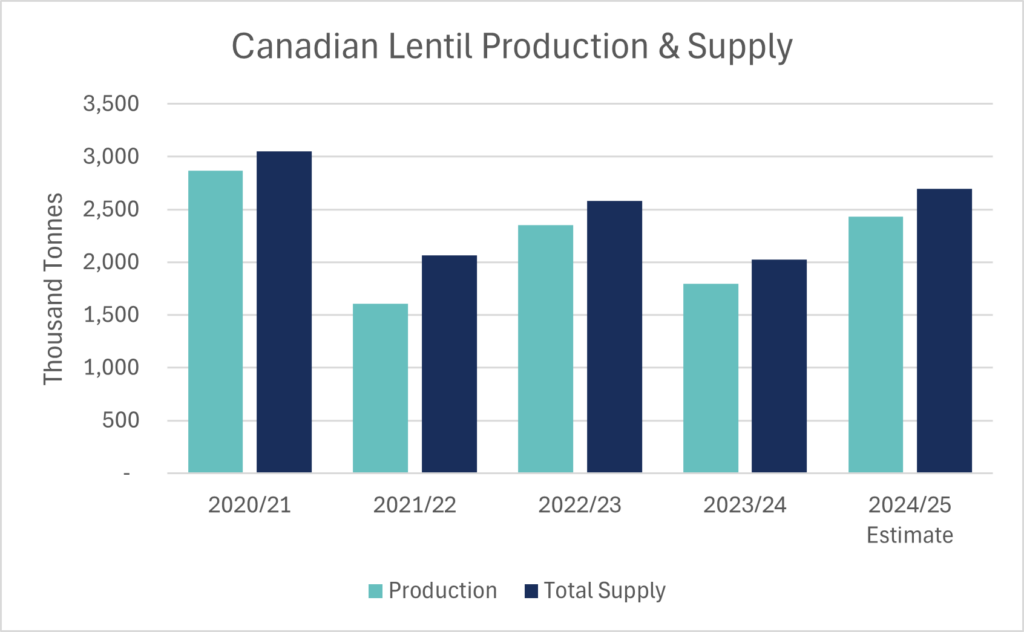

The “final” StatCan production numbers for lentils were also lowered by 162,000 tonnes from the earlier estimate to 2.43 million tonnes. This represents a big 35% increase in Canadian lentil production from the small 2023 production of 1.8 million tonnes. It still is well below the 2.9 million tonnes produced in 2020, and lower than expected by the trade during the summer. Lentil supply (production plus carry-in) increased by 33% to 2.7 million tonnes, the largest supply since 2020/21. While supply numbers by type of lentil are somewhat subjective, we estimate the large/ medium lentil supply at about 553,000 tonnes (460,000 tonnes last year), small greens at 239,000 tonnes (163,000 tonnes last year), and red lentils supply at 1.8 million tonnes (1.3 million tonnes).

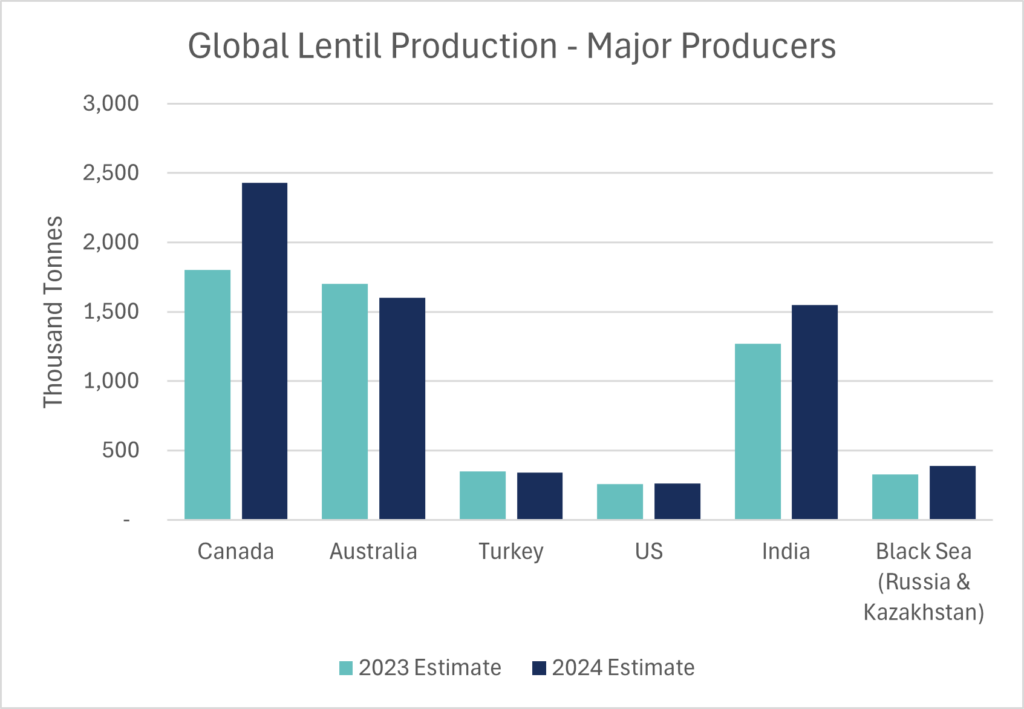

We calculate global lentil production (major producers) at about 6.6 million tonnes, up 15% from the 5.7 million tonnes produced last year. Canada, Australia, and India are the determinant producers of red lentils, while Canada and the US dominate green lentil production and exports. Production in Canada and in India is seen down from the previous year, while production in Australia is lower due to weather challenges despite a higher acreage last year.

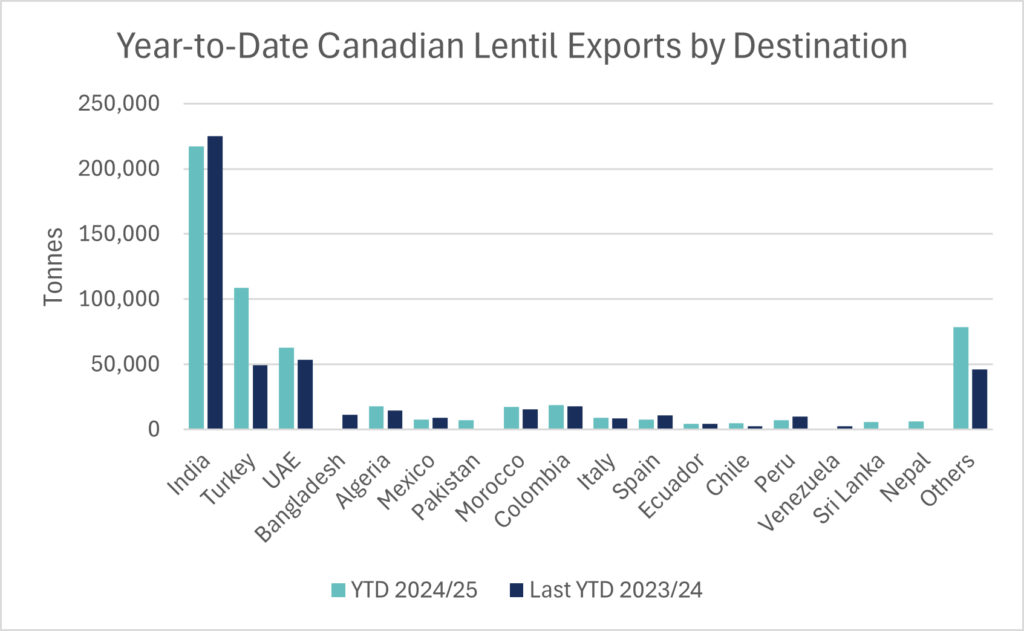

Nevertheless, demand for Canadian lentils has been quite good so far this crop year. Year-to-date Canadian lentil exports (August through October 2024) at 581,000 tonnes are 21% ahead of last year’s (+100,000 tonnes), mostly thanks to improved year-to-date exports to Turkey and to the United Arab Emirates (UAE). Tight supplies and high lentil prices over the past two years led to penned up demand for new crop lentils as importers hoped a bigger production would lower prices over the summer. This is especially true for green lentils, but also for reds as Australian production was expected to be larger than it turned out to be. In addition, total lentil import demand has been rising steadily since 2018, and inferred global use of lentils seems to have reached estimated 6.7 million tonnes in 2024. This development has underpinned continued solid lentil values and helps explain how the lentil market was able to absorb huge production increases in red lentils by Australia (+ 1 million tonnes from 2019 to 2022).

The graph above also shows that Canadian lentil demand is more diversified than pea demand, making this market a little more resilient to challenges with specific countries.

Uncommonly, Canada exported another 71,000 tonnes of bulk lentils over the Christmas break indicating ongoing demand and still has another 21,000 tonnes sitting in Vancouver export terminals waiting to be loaded. Mercantile projects total export demand for Canadian lentils in 2024/25 at 2 million tonnes (1.65 million tonnes last crop year), and anticipated ending stocks at about 380,000 tonnes, a 17% stock-use ratio.

We expect demand for both green and red lentils to remain good over the winter, and prices to remain stable. However, given lentil values compared to those of other commodities, we also expect lentil acres to increase again in 2025 in Canada as well as in Australia and Russia. We would therefore watch 2025 crop contracting opportunities as they arise.

Marlene Boersch is a managing partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.