By Marlene Boersch, Mercantile Consulting Venture Inc.

August 2021

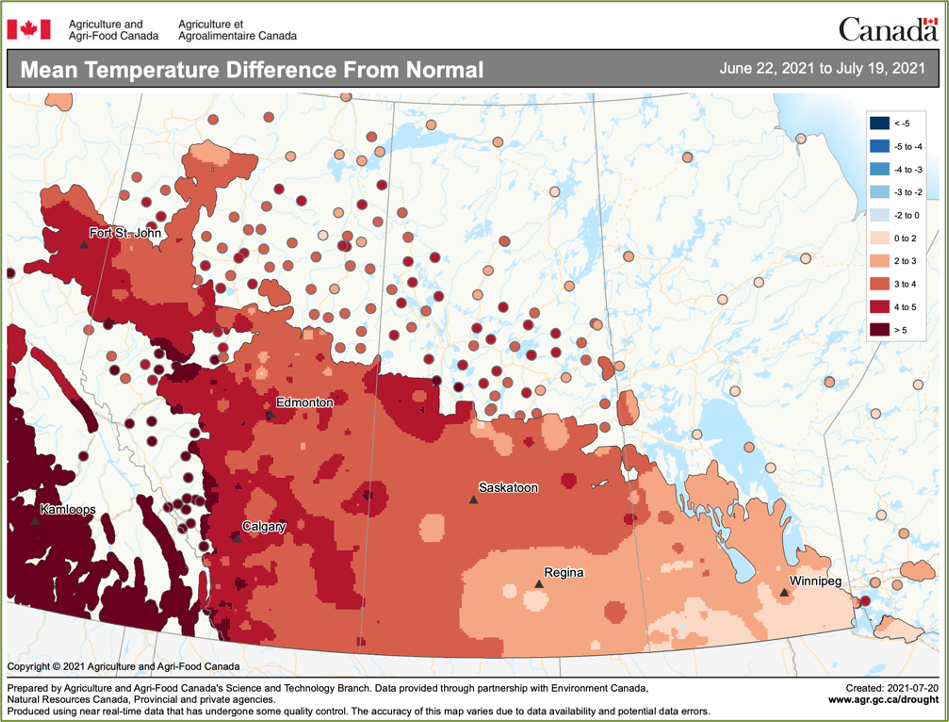

The last time we wrote about peas and lentils was in May and seeding had started with all hopes for a good year still intact. Seeding went generally well, but lack of moisture as well as heat during late June and July have taken their toll since then. While temperatures have eased over the past few days, partly due to smoke from forest fires and some precipitation, rain has been spotty to date and it is getting late for a meaningful crop condition reversal. Remembering that soil moisture was already quite low at seeding, the following charts on soil moisture and temperatures summarize the scale of the situation:

What does the prospect of a much-reduced Canadian pea and lentil crop mean to global markets?

To start answering this question, we need to review the prospective global and Canadian supply situation for these crops against typical demand for this crop year.

Peas

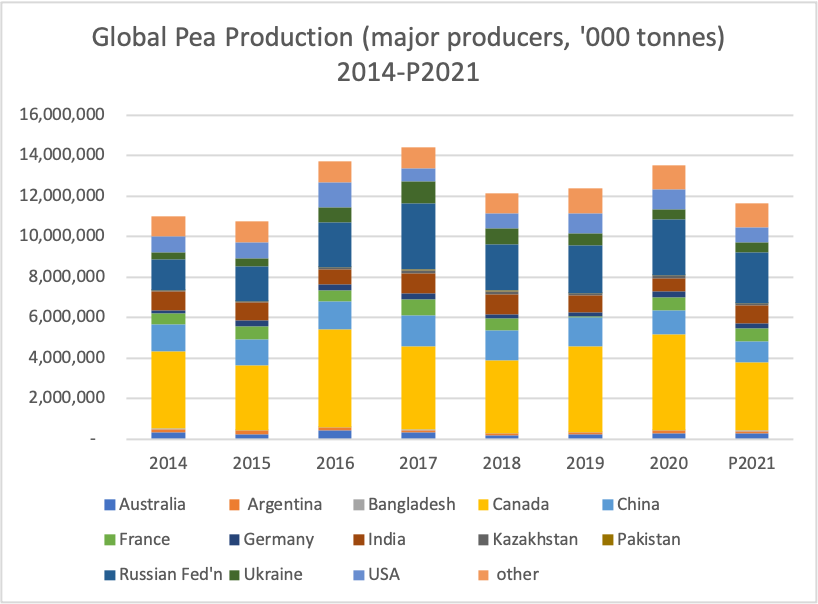

The world’s main pea producers are Canada, Russia, China, the European Union (EU), the United States (U.S.), India, and Ukraine, in order of importance. Pea production by the major producers should range around 13.5-14.5 million (M) tonnes. Earlier estimates for 2021/22 were at approximately 13.5 M tonnes. This assumed a 4.5 M tonne Canadian pea crop, which would represent approximately 35% of the total.1The relative size of the Canadian crop means that the global production number will be greatly affected by what is happening in Canada. The next largest producer is Russia, and the Russian and Ukrainian pea crop conditions have generally been good with above average yield expectations. This is isolating the main pea crop problems to Canada and U.S. and will somewhat cushion the pea crop problems in North America.

Source: Mercantile Consulting Venture Inc.

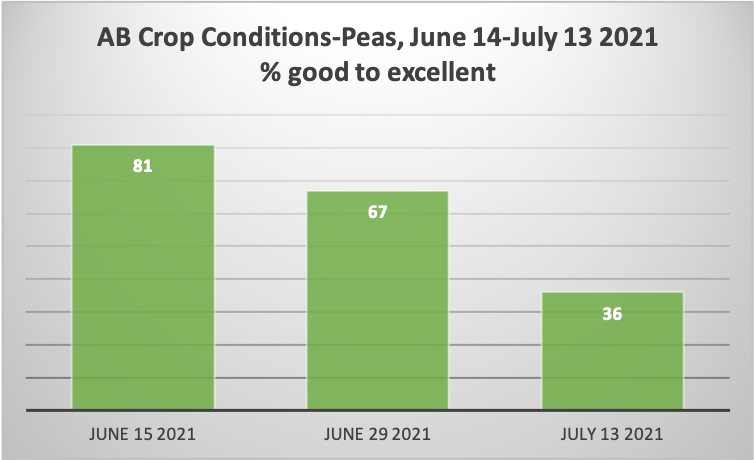

Condition rating developments for Canadian peas as reported by the provincial agriculture departments are shown below and chronicle the deterioration during June and July while it stayed hot and dry. In Saskatchewan, the good to excellent rating for peas came in at 80% on June 14, 2021, dropped to 55% on June 28, 2021, and to only 27% on July 12, 2021 (latest available at time of writing). In Alberta, the good to excellent rating for peas came in at 81% on June 15, 2021, dropped to 67% on June 29, 2021, and to 36% on July 13, 2021.

Crop conditions vary a lot regionally depending on June rainfall, any additional precipitation received, and on seeding dates. Pea pods this year tend to be shorter, and it is hard to tell if they can or will be filled or not. As the heat continues, plants have started to dry from the bottom up, not the top as would normally be the case. From the road, the pulse fields still looked surprisingly green in mid-July, but closer up they looked much thinner and shorter than normal. It is hard to say if the pods still forming will be able to fill with seeds at this point.

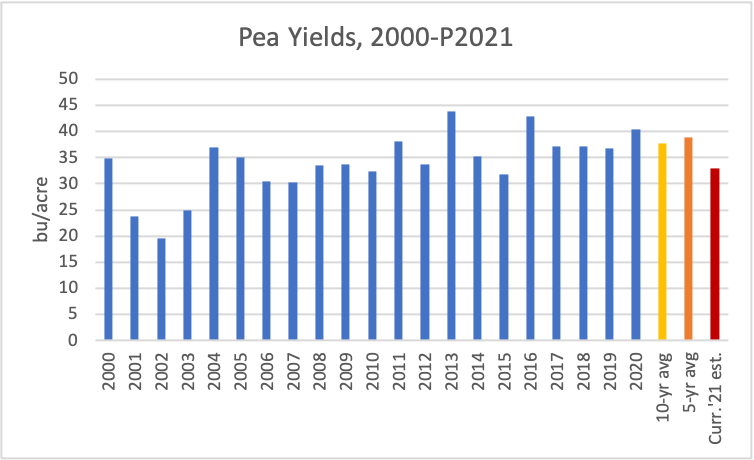

According to farmers and country brokers, peas are going to yield 20- 25 bushels per acre (bu/acre) (some farmers quote around 10 bu/acre for their crop) compared to a five-year average of 38.9 bu/acre and a 40.5 bu/acre yield last year. We prefer using a higher yield for now, given there are some decent crops and still a lot of unknowns about potentially filling the pods that are there. We prefer to lower or adjust the estimate as conditions prevail.

For context, the lowest average pea yield we have experienced in Canada over the past 10 years was 31.9 bu in 2015, and the lowest yield over the past 20 years has been 19.5 bu in 2002.

Lentils

The world’s main lentil producers are Canada, India, Australia, U.S., and Turkey. Global production should range from 6-7 M tonnes. Canadian lentil production generally represents about 44-46% of global production and about 65% of global trade, so they are very important to the overall balance sheet. In the spring, Canada was expected to produce about 2.7-2.8 M tonnes of lentils, but given the conditions, this will drop significantly, causing a significant drop in global production as well to below 6 M tonnes.

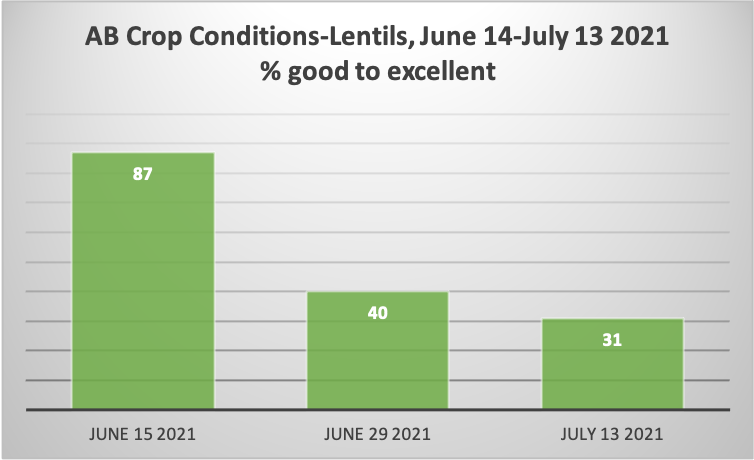

Similar to peas, provincial agriculture departments have also successively dropped lentil crop ratings. In Saskatchewan, the good to excellent rating for lentils came in at 73% on June 14, 2021, dropped to 49% on June 28, 2021, and fell to only 25% on July 12, 2021. In Alberta, the good to excellent rating for lentils came in at 87% on June 15, 2021, dropped to 40% on June 29, 2021, and fell to only 31% on July 13, 2021. We hear that crop insurance has started writing off some crops in the Lethbridge area.

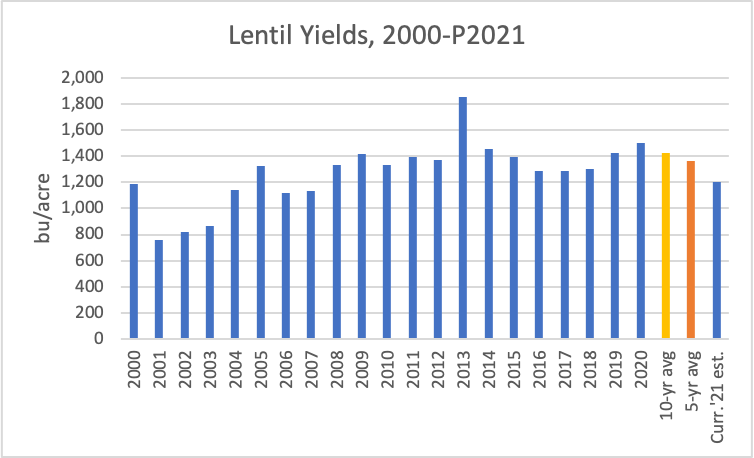

Some farmers are pegging red lentil yields at 900-1,100 pounds per acre (lbs/acre), and large greens at approximately 900 lbs/acre, but we are using 1,150-1,200 lbs/acre average for now while watching the crop. For context, the lowest lentil yield we have seen over the past 10 years was 1,283 lbs/ac in 2016, and the lowest yield over the past 20 years was a devastating 761 lbs/acre in 2001.

A yield of 1,150 lbs/acre would drop production to 2.24 M tonnes (2.9 M tonnes in 2020), drop supply to 2.53 M tonnes (3.2 M tonnes in 2020), and exports could be no higher than 2.2 M tonnes (vs. 2.7 M tonnes in 2020/21). Export rationing would be required, and the export markets would become quite tight.

We note that on July 20, 2021, AAFC was still estimating the Canadian lentil crop at 2.75 M tonnes based on a yield of 1,428 lbs/ acre. Again, AAFC increased the lentil yield from June to July. This estimate is problematic and could be misleading to farmers.

Marlene Boersch is a managing partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.