By Jon Driedger, LeftField Commodity Research

September 2025

After some early challenges, much of Western Canada experienced reasonably favourable growing conditions this summer, with early harvest results largely coming in above expectations. The initial Statistics Canada (StatCan) model-based production estimates showed the pulse crops above year-ago levels. This release used data to the end of July, which means the next report could show even bigger yields. When combined with a larger old crop carry-in from the previous season, supplies are set up to be the largest in several years.

Quality is also being monitored as the crop comes off. Early reports indicate that recurring rain events during the initial harvest caused delays and likely resulted in some downgrading. Conditions have improved since then, and a full assessment of overall quality will only be better known once the crop is in the bin.

When stocks are plentiful, export markets are tasked with providing enough demand to avoid inventories backing up on-farm. Price pressure is already being felt, in some cases quite significantly, and the potential for a meaningful rebound is uncertain, depending on the crop. In general, large supplies sets up for a season where even a modest rebound in bids triggers a pick-up in farmer selling.

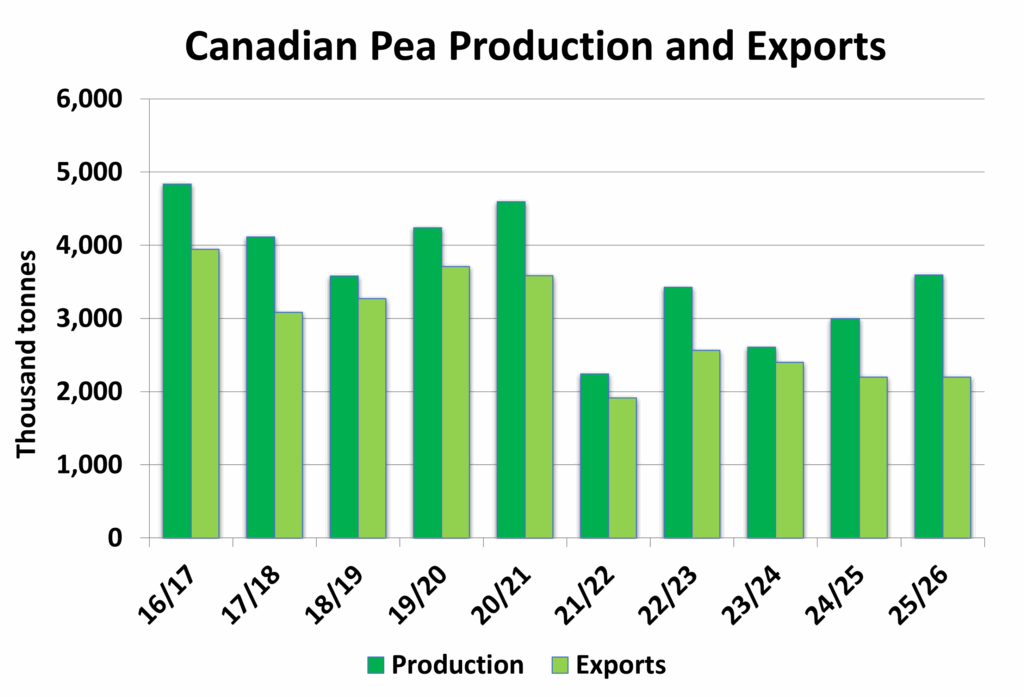

Pea Production Larger and Export Movement Uncertain

The initial StatCan estimate put the total pea crop at 3.4 million tonnes, a 13.7% increase from the previous season, and with the final number likely being even higher. A breakdown by type was not given, although seeded area data from June allows for reasonable indications. Yellow pea production may be up by roughly 17% to around 2.8 million tonnes, while green pea production could be 30% higher or more, exceeding 700,000 tonnes. Total supply for both yellow and green peas look to be the biggest since 2020/21.

While a larger crop naturally weighs on prices, the greater challenge for peas comes from the demand side. The most significant barrier is import tariffs on Canadian peas from China, which had been our largest export market for the past seven years. While there is the ability to ship more peas to other countries, there is no easy way to fill that big of a demand hole. As with all policy decisions, it is possible China reverses course and reopens their market, but that is not the more likely scenario in the short term.

Volumes to India have improved in the past two seasons, and it is critical that movement maintains or exceeds those levels in 2025/26. Whether or not that is the case will partially be a function of their winter rabi production. Indian pea prices have been slipping recently, which will not encourage purchases. Even though yellow peas can unlock new buying interest into other destinations when prices are discounted, fresh markets take time to develop, and even then it may only partially fill the demand gap at best. In addition, United States (U.S.) production is higher in 2025, and Canada will face competition from other exporters such as Russia, Ukraine, and Australia. Barring China unexpectedly lifting tariffs and India buying surprisingly large volumes, there is no escaping Canadian pea inventories sitting at burdensome levels at the end of the 2025/26 season.

Green pea exports tend to not fluctuate a great deal from one season to the next. This is one reason why prices can rally to lofty levels when stocks are tight, but it also means lower values do not typically trigger much of a bump in demand. Even if there is an increase in shipments, stocks will be large at the end of the season, keeping prices under pressure.

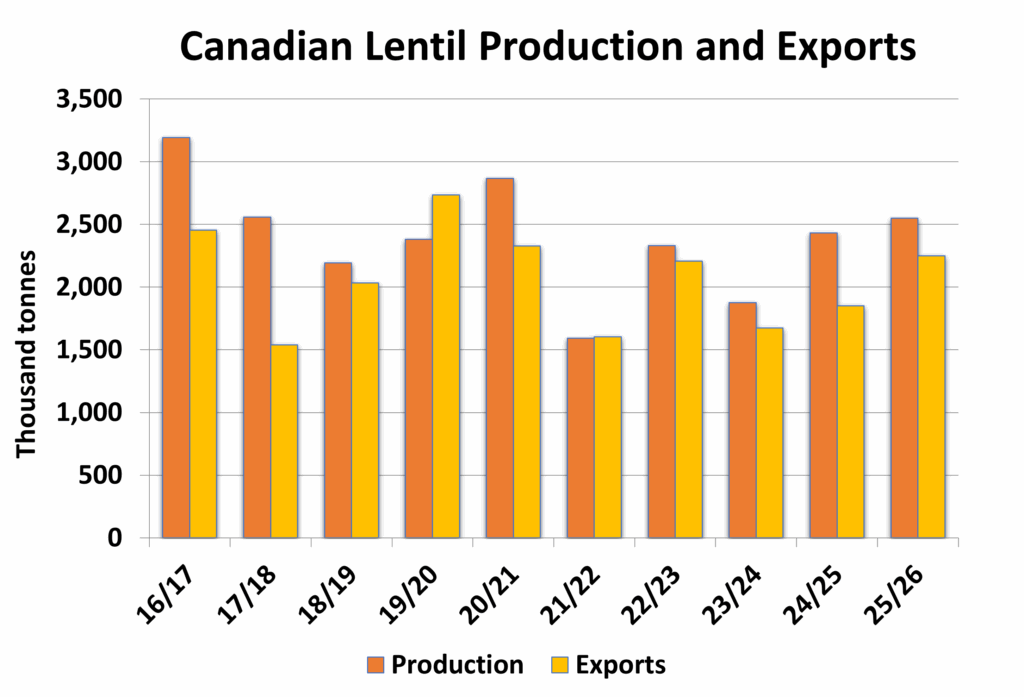

Lentil Production and Exports Higher This Season

The initial StatCan lentil production estimate came in at 2.7 million tonnes, up 9.2% from last year and the biggest crop since 2020, and it is possible yields are even larger in the next update. There was no breakdown by type, although seeded area figures from June give an indication of what those numbers could look like. Lower red lentil acres in 2025 will result in smaller production, possibly around 1.4 million tonnes, from 1.7 million last season. This means all the increase, and more, will come from green lentils, where big plantings will result in production exceeding 1 million tonnes.

The ability for export markets to work through Canadian supplies will vary by type. There is potential for good red lentil movement during the coming season, particularly into Turkey as their domestic prices strengthen. At the same time, demand from India has been quiet. Australian yields could be below average this season, although they may still harvest a larger crop than last year, while more production from Russia and Kazakhstan adds to global competition.

Green lentil exports will struggle to work through the large stocks. Exports tend to not increase much even when prices are lower, making it difficult to clear supplies in years of big production. In addition, U.S. lentil acres are the highest since 2017, most of which are greens. India’s tur (pigeon pea) plantings will be down this year, which may encourage more green lentil imports, although domestic prices are low and they have been bringing in larger volumes of tur from other countries. All of this points to prices having limited upside potential and supplies remaining heavy at the end of 2025/26.

Larger Canadian Chickpea Production

The initial StatCan chickpea production estimate came in at 309,000 tonnes, up 7.6% from 2024 and the largest since 2018. A larger old-crop carry-in further adds to the total supply.

Export movement is a potential bright spot for chickpeas, with shipments hitting a record pace in 2024/25, and Pakistan being a notable buyer. The U.S. is often our largest export market, and dry conditions in some key growing regions could see production down from last year, despite plantings being the highest since 2018. Mexico’s crop is also smaller this year. At the same time, bigger crops in the Black Sea and Argentina will keep pressure in global markets, particularly for smaller caliber Kabulis. While large supplies will limit upside potential, prices could see some firming later in the year.

Jonathan Driedger is Vice President with LeftField Commodity Research. He can be reached at jon@leftfieldcr.com.