By Chuck Penner, LeftField Commodity Research

October 2022

It has been a challenging couple of years for faba beans in Western Canada. Last year, seeded area was the highest in years but drought hit yields hard, with a 2021 crop estimated by Statistics Canada (StatCan) at only 73,000 tonnes, the lowest in years.

In 2022, seeded area of faba beans dropped sharply as planting delays in Saskatchewan and intense acreage competition took a toll on acreage. StatCan reported seeded area at 27,000 acres, 46% less than last year and the lowest since 2013. Seeded acreage from provincial crop insurance data suggests it could be even less. StatCan has not issued any 2022 faba bean yield estimates yet, but even with a return to an average yield, production would only partly recover from 2021.

Canadian Faba Bean Production

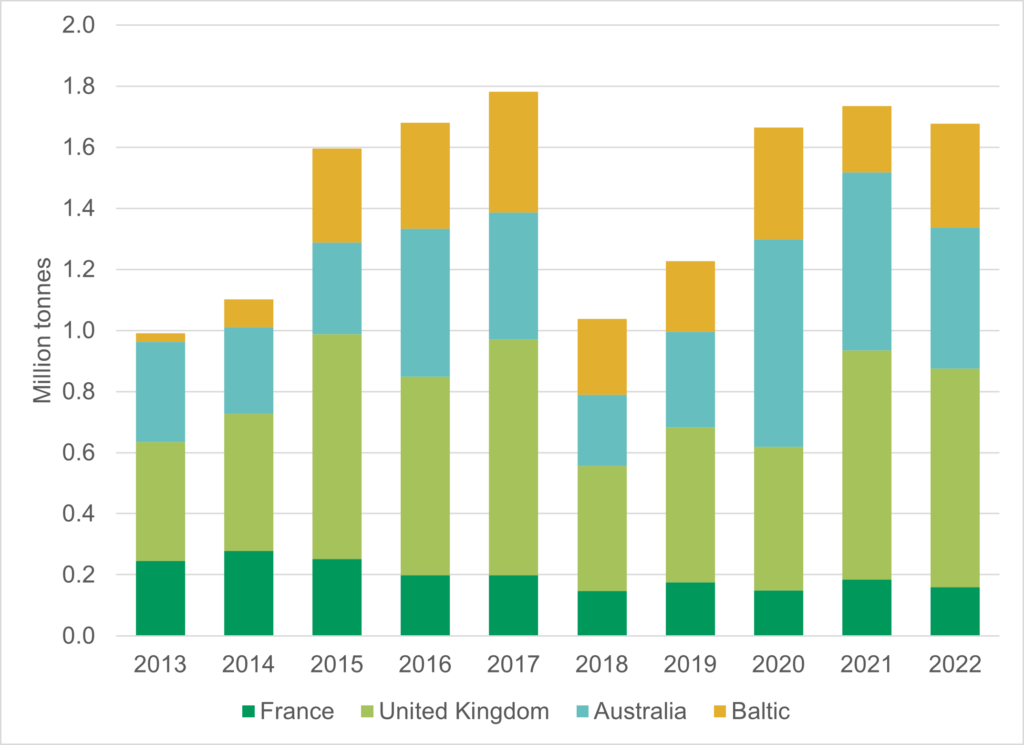

Globally, the faba bean outlook is also mixed. According to Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the Australian crop is expected to shrink by 20% from last year. It is the second straight year of declines but is still a good-sized crop. In several key European countries, faba bean production is also expected to slip in 2022. The exception is in the Baltic countries where seeded area bounced back, and yields are reported to be solid.

Faba Bean Production – Selected Exporters

Overall, there are plenty of faba beans to meet import demand from Egypt and a few smaller buyers, which should keep prices steady.

Through ten months of its marketing year, Australia has exported 540,000 tonnes of faba beans, a record pace. While Egypt is the dominant destination, other buyers in the Middle East and Southeast Asia have taken meaningful amounts from Australia.

Once again in 2022/23, faba bean prices in Canada and elsewhere will be strongly influenced by the feed market, including other pulses, soymeal, and feed wheat. Currently, the feed complex feels well balanced but could firm up a bit as the marketing year progresses.

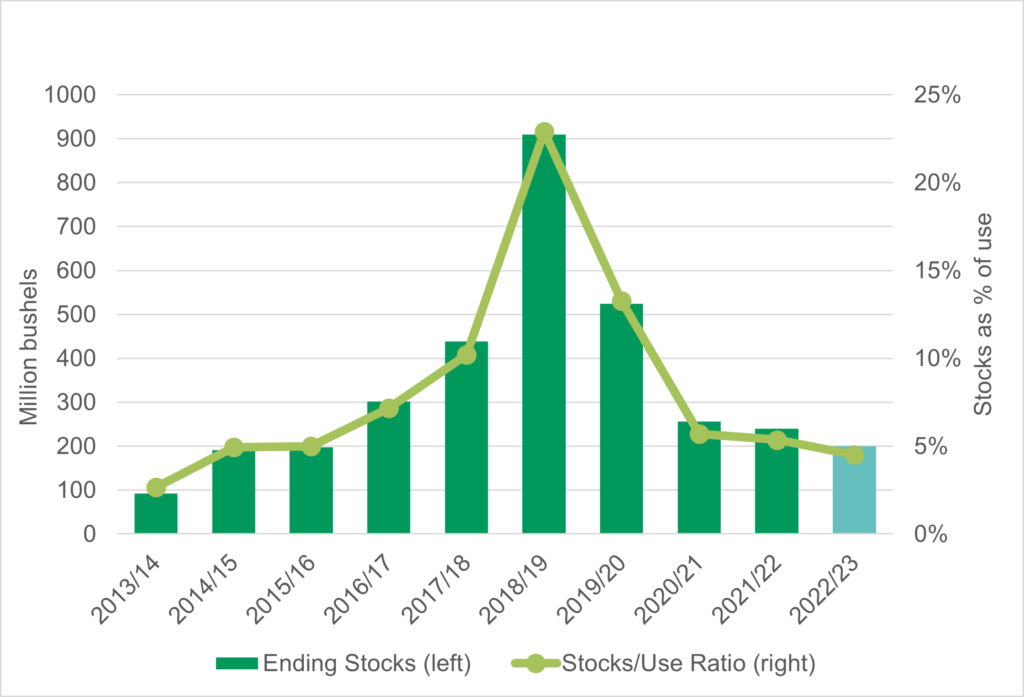

StatCan’s latest estimate of the Canadian soybean crop was 6.5 million (M) tonnes, the biggest crop in four years. This estimate was based on a yield of 46.1 bushels per acre (bu/ac), the second largest on record, with solid yields expected in both Western and Eastern Canada. Canadian soybean production is not large enough to have a significant influence on the global market, but a big 2022 crop could mean weaker basis levels north of the border. The global soy complex has been experiencing uncertainty and big volatility lately. The latest surprise came courtesy of the United States Department of Agriculture (USDA) when it reduced both seeded area and yield for the 2022 United States (U.S.) soybean crop. At 4.38 billion bushels (119 M tonnes), it is still not a small crop and only down 1% from last year but that is not what traders were expecting. And it will cause supplies in the U.S. to tighten up even more.

U.S. Soybean Ending Stocks

The bigger developments are happening even further south, in Brazil and Argentina. Even though the 2022/23 crop has not been planted yet, there are forecasts of massive soybean production in Brazil, well beyond the previous record. The USDA is forecasting the South American soybean crop will be up 36 M tonnes from last year’s disappointing results and 15 M tonnes more than the previous record. Of course, when expectations are that high, any glitches in the outcome could trigger a sharp move in the markets.

On the demand side of the soybean market, China is always the biggest topic of conversation and there is plenty to talk about these days. On one hand, drought in the south of the country could boost Chinese imports of agriculture commodities to offset a smaller crop of rice and other grains. At the same time though, an economic slowdown, COVID-19 shutdowns and high inflation will likely reduce consumption, not exactly bullish. These competing factors make it difficult to predict how events in China will turn out but either way, the soybean market will be affected.

It is still early days for the 2022/23 marketing year. Besides the factors already identified, other developments will inevitably show up. Weather events, good or bad, geopolitical unrest, economic volatility, and other factors could all have an influence in the next few months. The story will unfold piece by piece, and that is why marketing a crop is not just a one-act show.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.