By Chuck Penner, LeftField Commodity Research

October 2023

There is still plenty of debate about the size of Canadian pulse crops for 2023, with different ideas about yields and acreage. With the harvest nearly complete, attention can shift to the demand side of the equation outside of Canadian borders. It is clear that Canadian pulse production is down sharply and, in some cases, close to the 2021/22 drought year. At the same time, there are different dynamics for some key importers, which means 2023/24 price behaviour could be quite different than 2021/22.

One thing that is already noticeable in the early stages of 2023/24 is that each of the pulse crops and classes is responding differently to changing market factors. Yellow peas are not behaving the same as greens and maples. The situation for green lentils is different than reds.

The dominant factor in the yellow pea market has been demand from China, and this will continue in 2023/24. A few years ago, when yellow pea prices were low, China imported massive volumes with a large portion going into its feed market but since prices rose in 2021/22, yellow peas have dropped out of Chinese feed rations. That feed demand will not resurface in 2023/24, especially if soymeal and corn prices remain under pressure.

The new factor in the yellow pea market for 2023/24 is that Canada now has competition in the Chinese market from Russia. In the last few months, Russian peas have started to show up in China’s trade data and volumes are growing. Previously, Canada had often accounted for over 90% of Chinese pea imports but in the last two months, that has dropped below 50%. Even though Canada will still be a large source of peas for China, its buyers are benefiting from more competition, and that is keeping Canadian yellow pea prices from responding like they did in 2021/22.

It is a different picture for green peas. For one thing, seeded area of green peas was down sharply in Canada and a bit lower in the United States (U.S.) too. Aside from these two countries, there is not much export competition. From the demand side, China is still a sizable buyer of greens but not as dominant as in yellows. Most green pea buyers are less price sensitive and do not cut back their purchases when prices rise, which means low supplies tend to cause a larger price reaction. We are already seeing that strength for green pea bids in the first few weeks of 2023/24 and an even stronger spike in maple pea prices.

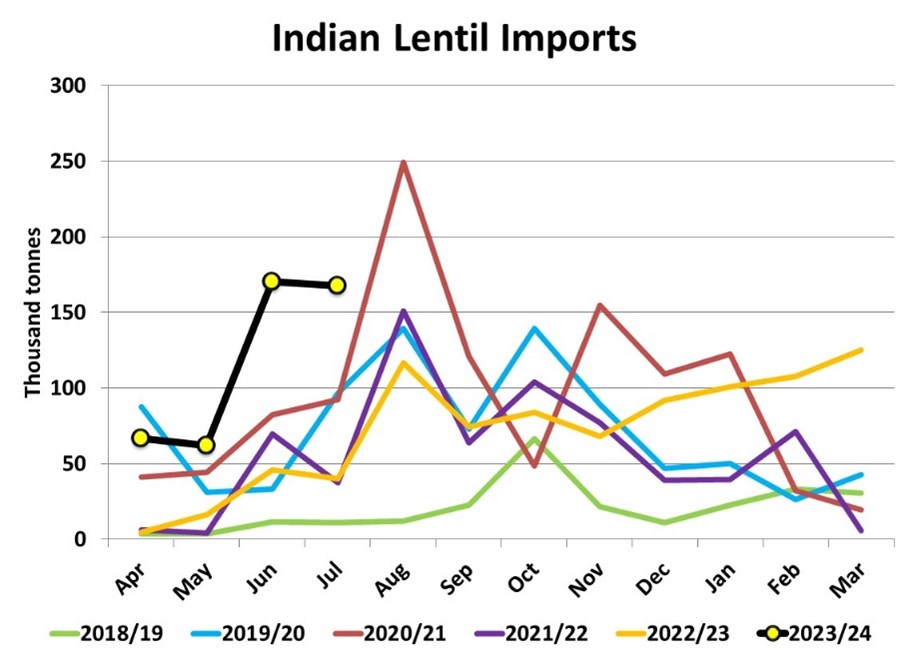

India has always been a large factor in the red lentil market, but its influence is becoming even greater in 2023/24. Early in 2023, India’s lentil harvest was reported at a near-record output of 1.6 million tonnes, and it looked like it would need to import fewer lentils. It has not turned out that way though and instead, imports are running at record levels early in India’s 2023/24 (April-March) marketing year. The increased demand for lentils is driven by declines in other Indian pulse crops and will continue through the medium term, if not longer. The latest diplomatic tensions might cause problems, but India can not really afford to restrict pulse imports right now.

Australian red lentil production has expanded since 2021/22. In 2023/24, Aussie farmers are producing their second largest red lentil crop ever at 1.2 million tonnes, although that is down 27% from last year. Together, red lentil crops in Canada and Australia will be roughly 2.2 million tonnes, down 1.3 million tonnes or 37% from last year, and will put a large dent in global trade.

Green lentil production is also down in Canada, but acreage declines were not as severe as for reds and supplies have not been hit quite as hard. The lentil crop in the U.S., the only other sizable exporter, was steady. Just like green peas, green lentil demand is spread across a large number of countries, most of which are not very price sensitive. Importers’ concerns about green lentil supplies have caused Canadian bids to firm up and that trend will likely hold.

One other clue about the tightness in the green lentil market is the unusually narrow spread between large green and small green lentil bids. This narrow price difference suggests users are already starting to substitute in smaller greens into their products.

So while Canadian pulse production is down in 2023/24, there may not be a repeat of 2021/22. For some pulses, prices could be more subdued while others could head even higher.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.