By Chuck Penner, LeftField Commodity Research

October 2024

Canadian pulse crops are now in the bin and it is safe to say that after an optimistic start to the growing season, the results were disappointing. From a positive perspective, 2024 pulse yields were generally better than the poor results in 2023 and the quality was mostly good. On the negative side, yields were below long-term averages, especially in the South.

Even though the Canadian results are becoming clearer, there are still a number of moving parts in global pulse markets that could eclipse the situation in Canada. Some of these question marks are on the supply side of the equation with some even larger unknowns for demand.

Peas

In the world of pea exports, Russia has emerged as a much larger competitor in the last year and the situation there needs to be watched carefully. Peas are grown across a wide geography in the country and have faced various challenges in the 2024 growing season. In the South, hot and dry conditions reduced yields while in Siberia, rains at harvest time reduced quality. Just like in Canada, expectations were very high early in the season with some production forecasts over 5 million tonnes versus 4.7 million tonnes in 2023. Reports from various sources suggest a million tonnes of that early potential has been lost. Even so, Russian traders are reported to be aggressively pursuing the Indian market. Keep in mind, recent tariffs mean Russia won’t be able to export to the European Union (E.U.) (over 700,000 tonnes in 2023/24) and will be trying to find a home for those peas elsewhere.

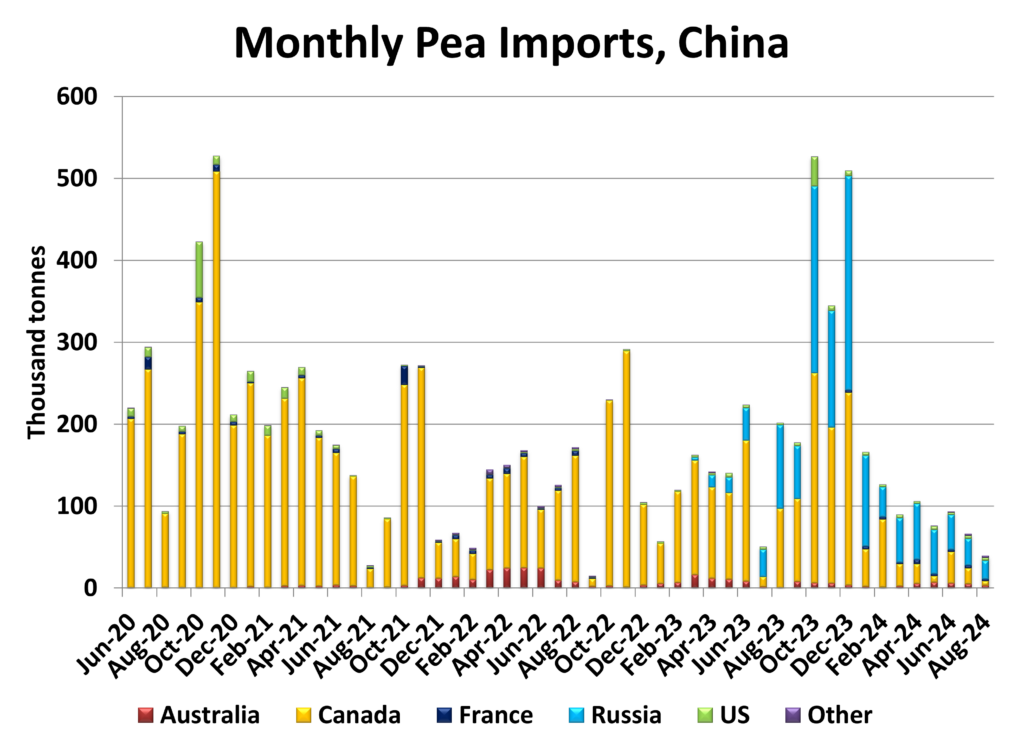

On the demand side of the coin there has been a lot of discussion recently about the situation in India, but we cannot forget that China has been Canada’s largest customer for a number of years. Unfortunately, market signals from there are not all that friendly right now. Not only have total Chinese imports been dropping, but now Russia has become the largest source of peas. Demand is expected to recover once large Chinese pea inventories have been drawn down, but overall volumes will not reach the highs of previous years.

India has extended the zero tariffs on yellow peas for another two months to the end of December and that seems to have spurred more trade. The good news is that through the first few weeks of 2024/25, Canadian pea exports are running at the fastest pace since 2020/21 and India is likely the destination for many of them. While export volumes will likely increase, yellow pea prices in India have slipped lower again and that will not allow room for much upside in Canadian bids.

Even though Canadian and United States (U.S.) production of green peas are up this year, this portion of the market has been quite firm early in 2024/25. Prior to this year’s harvest, global supplies of green peas had been extremely low and importers have been buying aggressively to rebuild their inventories, which is providing support for prices. And because green pea demand is spread across a larger number of countries, there is less room for trade policy to affect Canadian exports.

Lentils

For red lentils, the supply side is dominated by Canada and Australia although Russia and Kazakhstan have been trying to boost their role in this market. The Canadian harvest is now complete and quality is mostly favourable with decent yields. The biggest question mark is production in Australia, where lentil crops have been facing dry conditions and more recently, frost. The overall impact is not yet known but, just like Canada, the early optimism has faded. In key lentil-growing areas of Russia and Kazakhstan, harvest weather has turned very wet, with quality and yields both threatened.

As always, India dominates the demand outlook for red lentils. Import volumes have not been all that “exciting” in recent months and Australia has become the largest supplier. We expect Canadian exports will pick up as they normally do in fall but beyond that, the size of the Australian crop will determine whether Canada keeps exporting at a good pace.

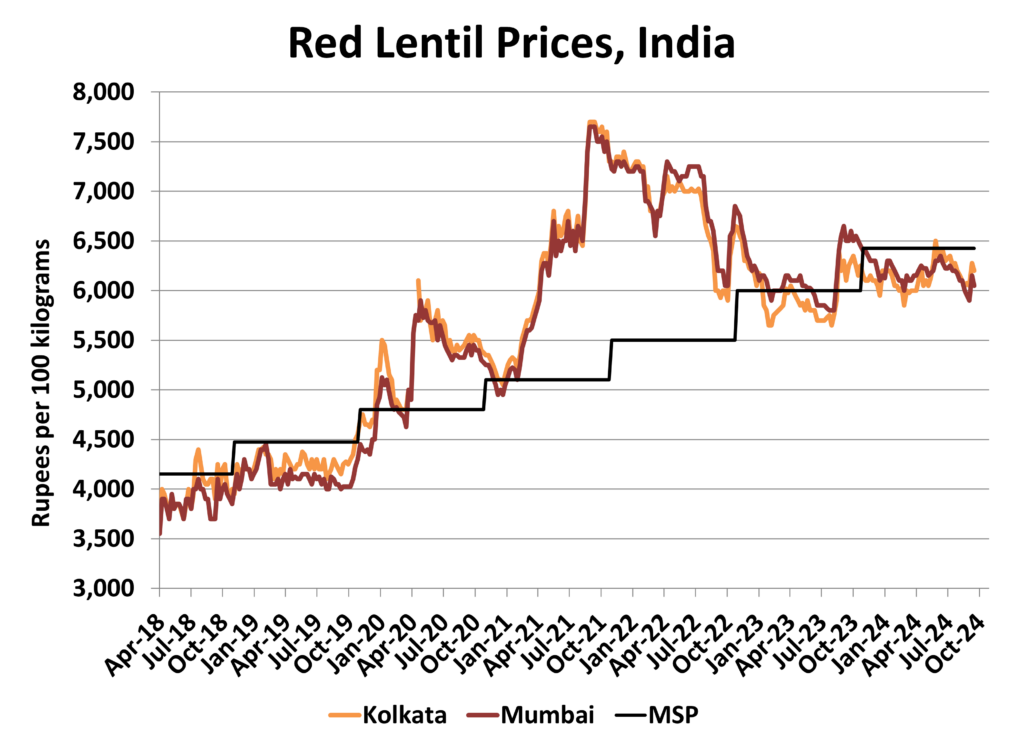

Red lentil prices in India have mostly been moving sideways for at least a year and appear to be supported by the Minimum Support Price (MSP) set by the Indian government. Lentil inventories in India are reported to be comfortable with imported and domestic lentils. As long as this flat price direction continues, there will not be a lot of upside potential for red lentil bids in Canada. It remains to be seen how Indian farmers will respond to these prices and the MSP as they make decisions about how many lentils to plant in the upcoming rabi season. Even if the Indian outlook does change, it will not likely become clear until the turn of the calendar year.

Green lentils are in a similar position as green peas. End-users have been running on “fumes” in terms of old-crop supplies and are busy restocking their shelves with the 2024 crop. Even with some disappointing yields, production is up in Canada and the U.S. Despite the larger crop, prices have been firming up as trade has been brisk and that strong pace will continue for at least a few months.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.