By Chuck Penner, LeftField Commodity Research

October 2025

With the Canadian harvest now approaching the finish line, we are getting a better picture of the 2025 crop situation. While there were certainly trouble spots, most reports point to very positive yield outcomes. After a few years of disappointing performance, we got a reminder in 2025 of how well crops can perform under more moderate weather conditions. One of the most common words we heard during harvest was “surprised”, in a good way. For both faba beans and soybeans, however, the situation in Canada is only a small part of the global market picture.

Faba Beans

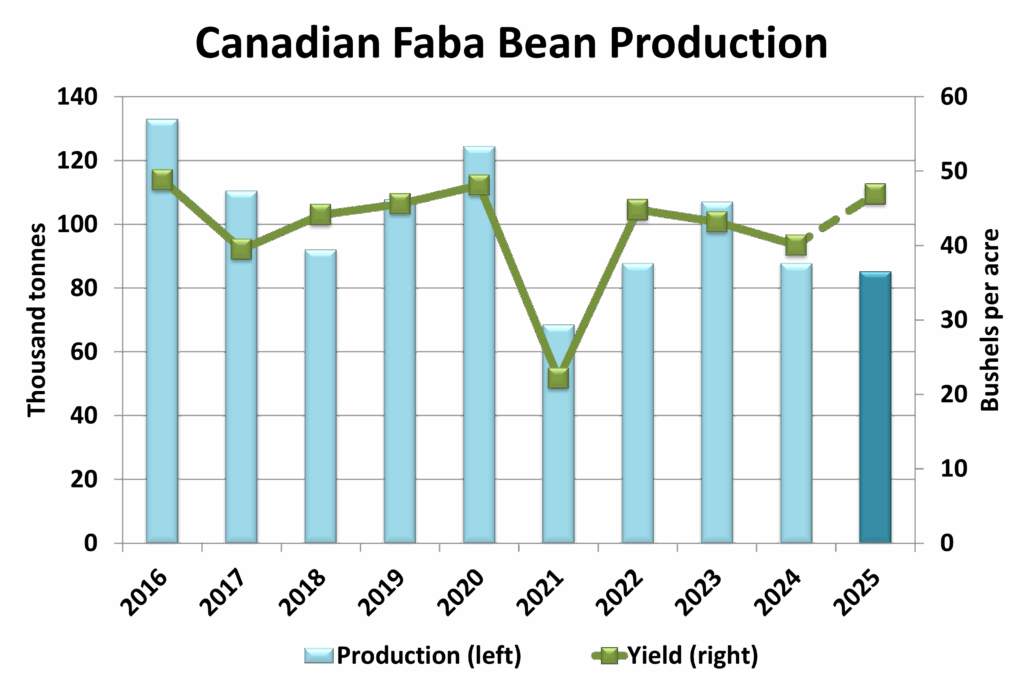

Back in June, Statistics Canada (StatCan) reported 68,800 acres of faba beans were planted in 2025, 15% less than the previous year, with most of the decline occurring in Saskatchewan. So far, StatCan has not released any yield estimates for the 2025 faba bean crop but with all other crops showing above-average performance this year, the same should be true for faba beans. If we plug in a yield of 46.9 bushels per acre (bu/ac), 10% above the five-year average, it would mean a 2025 faba bean crop of 85,000 tonnes, nearly offsetting the reduced acreage.

Most of Canada’s faba beans are used domestically, particularly for livestock feed. Even so, exports are still an important part of the faba bean picture. In 2024/25, 13,600 tonnes or 15% of the crop were exported. A little over half of those went to the United States (U.S.), but South Korea, Egypt, and Denmark also took some meaningful amounts.

Last year’s export performance suggests there is potential for more market development, but domestic demand is still key. That is especially the case since some other key exporters have increased production. Australia dominates the global market and in 2025/26 is expected to produce a record crop of 850,000 tonnes, ten times the size of Canada’s production. Output from other countries is mixed, with the United Kingdom (U.K.) looking at another small crop in 2025 while production in the Baltic countries will be steady and the French faba bean crop larger. Faba bean prices in the benchmark Australian market have been dropping recently as its harvest approaches.

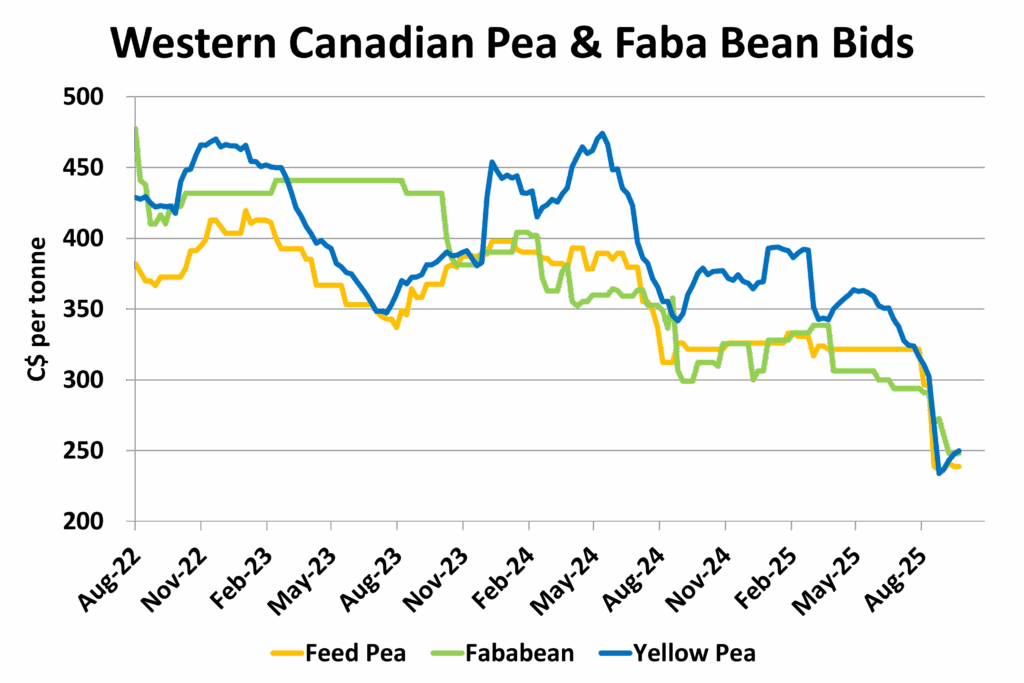

With most of the Canadian faba bean crop ending up in the domestic feed market, prices will largely be determined by other ingredients in rations, particularly feed peas. A large increase in the Canadian pea crop coupled with trade restrictions from China have depressed that market and faba bean prices have followed those declines. Unfortunately, unless there is a reversal in Chinese tariffs, Canadian pea prices will struggle to show much strength from the harvest lows and that will limit gains in the faba bean outlook.

Soybeans

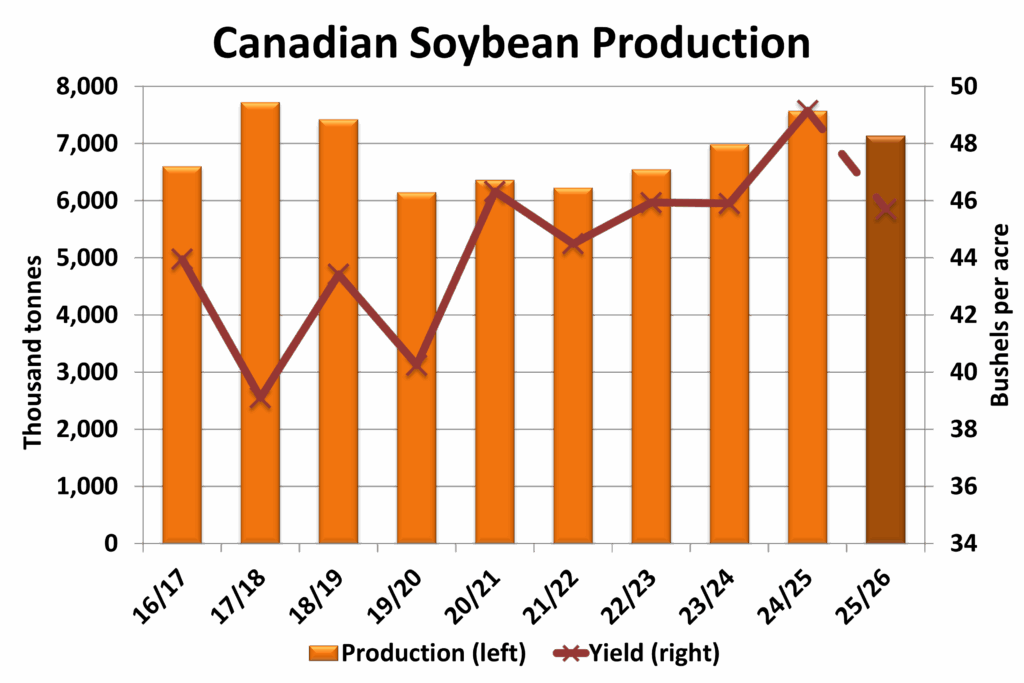

Soybeans are one of a few Canadian crops that could have lower production in 2025/26. Largely, that is because the largest share of acres are in Eastern Canada, with parts of Ontario experiencing drought this year. The latest StatCan estimate shows 2025 production at 7.13 million tonnes, down 6% from last year, as a larger Western Canadian soybean crop was not enough to offset the drop in eastern production.

Even though this year’s crop is down from last year, it is still historically large. Canadian soybean exports ran at a near record pace for 2024/25, and that strength could continue in 2025/26. While that is positive, Canadian soybeans are only a small part of the global picture and price direction will be dictated by much larger producers and exporters.

According to the United States Department of Agriculture (USDA), 2025/26 global soybean production will be 426 million tonnes, only slightly larger than the previous year. Small declines in the U.S. crop will be offset by larger production elsewhere, especially in Brazil. In theory, steady production should mean a stable price outlook for 2025/26 but unfortunately, politics and trade disputes are disrupting the market. In particular, the tariff-related standoff in U.S.-China trade relations is putting a damper on U.S. export prospects and that has been weighing on U.S. soybean futures.

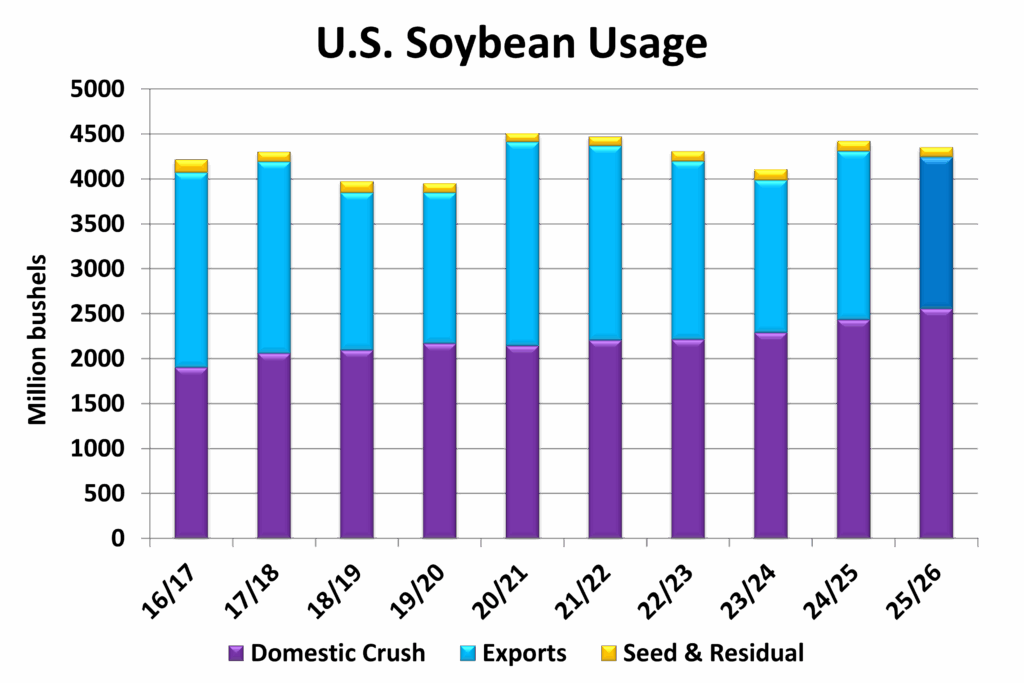

The largest portion of U.S. soybean demand comes from domestic crush, which means it is heavily influenced by biofuel policy. Soybean crush in the U.S. hit a new record in 2024/25, largely due to increased demand from the biofuel sector and that is forecast to rise further in 2025/26. This rising demand is positive for the soybean market in the U.S. and is forecast to trim U.S. ending stocks for 2025/26. That said, federal biofuel policy has not been finalized by U.S. regulators yet and that leaves the soybean market slightly vulnerable to changes in the program details. During the months-long approval process, hints of possible tweaks to the program parameters have caused soybean and soybean oil futures to swing sharply.

It is still early days for the 2025/26 soybean marketing year. Besides the factors already identified, other developments will inevitably show up. Weather events in South America (good or bad), more geopolitical unrest, economic volatility and other factors could all have an influence in the next few months. The story will unfold piece by piece, and that is why marketing a crop is not just a one-act show.

Chuck Penner operates LeftField Commodity Research out of Winnipeg, MB. He can be reached at info@leftfieldcr.com.