By Jon Driedger, LeftField Commodity Research

September 2024

It has been another challenging year for many Prairie farmers as a wet spring transitioned to a hot and dry summer. Even so, Canadian pulse production will be up significantly in 2024 as farmers responded to high prices by increasing seeded area, while yields will also be up. This was affirmed by the initial Statistics Canada model-based estimates released in late August. This initial release used data to the end of July, which inevitably means there will be adjustments to the numbers by the time harvest is wrapped up, but affirms the general year-over-year trend. The old crop carry-in will be lower than the previous year for most pulses, which reduces the increase in total supply. Even so, inventories will be higher this coming season.

While attention is naturally focused on the supply side of the equation at this time of year, demand is equally important. The outlook for Canadian pulse shipments is a little more uncertain given questions around import demand in some key countries and good production by other exporters. While much has yet to play out, any possible upside to Canadian pulse prices could face headwinds from both larger supplies and increased competition in global markets.

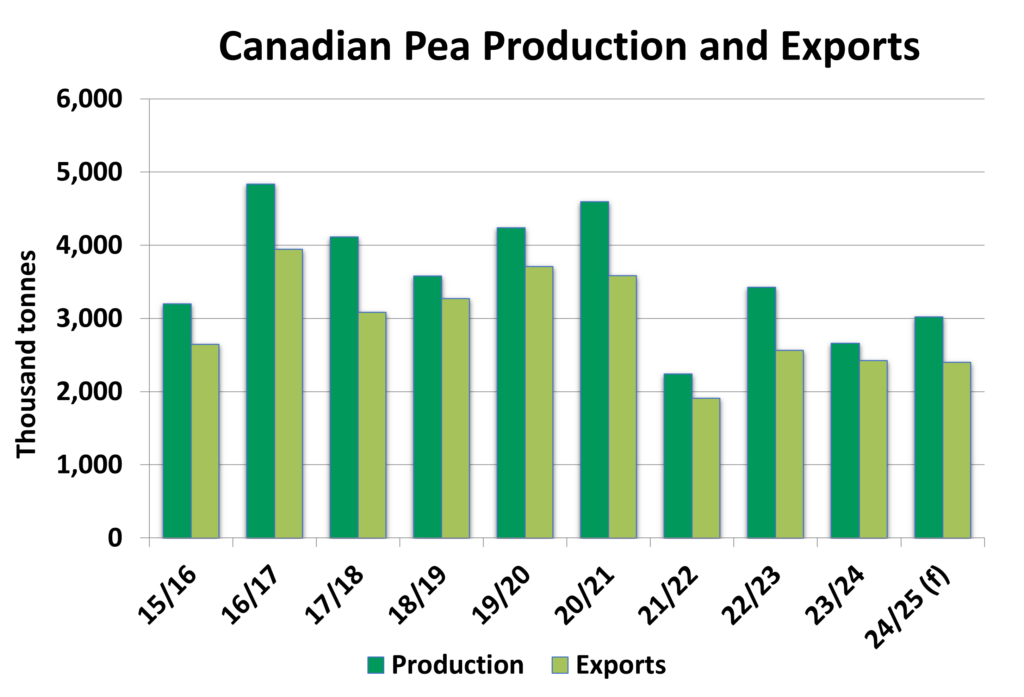

Pea Production Up, but Export Demand May Lag

The initial Statistics Canada estimate put the total pea crop at 3.01 million tonnes, a 15.3% increase from the previous season, and a bit below our estimate of 3.15 million tonnes. Statistics Canada did not provide a yield breakdown by type but based on earlier acreage data, it is expected yellow pea production is up over 10% in 2024, while green pea production is over 40% higher and crop size for other types of peas may have more than doubled.

While pea production and supplies will be higher for the 2024/25 season, it is possible exports may only stay flat, and possibly even dip. China has been an enormously important market, but shipments for the coming year are uncertain as trade actions by the United States (U.S.) and European Union (E.U.) could crimp their food and fractionation industries, reducing import needs for human food consumption markets. In the meantime, Russian peas are working their way into feed channels, which are also pressured by declining prices for soymeal and other ingredients.

India’s lifting of import tariffs provided a huge boost to Canada’s pea exports in the first half of 2024, but it is not known if that will be extended beyond the October 31 deadline. If so, that would significantly improve export potential, and the recent uptick in their yellow pea prices and strong desi chickpea values might give reason for some optimism. However, our export outlook will remain cautious until there is an extension of the zero-import tariff policy, and Canada would also continue to face competition into that market from other exporters.

Green pea exports tend to fluctuate less from one year to the next due to a larger number of key importing countries. This lends itself to prices surging when supplies are tight, such as in 2023/24, but also means there are limited additional outlets when stocks are larger, as is the case in 2024/25. This sets up green pea values to trade lower this coming season, both in outright price and their premium relative to yellows.

The recent announcement of an anti-dumping investigation by China into Canadian canola is not likely to broaden into pulses. However, given their importance for Canadian pea exports, a widening of the crops being considered would have a negative effect on prices.

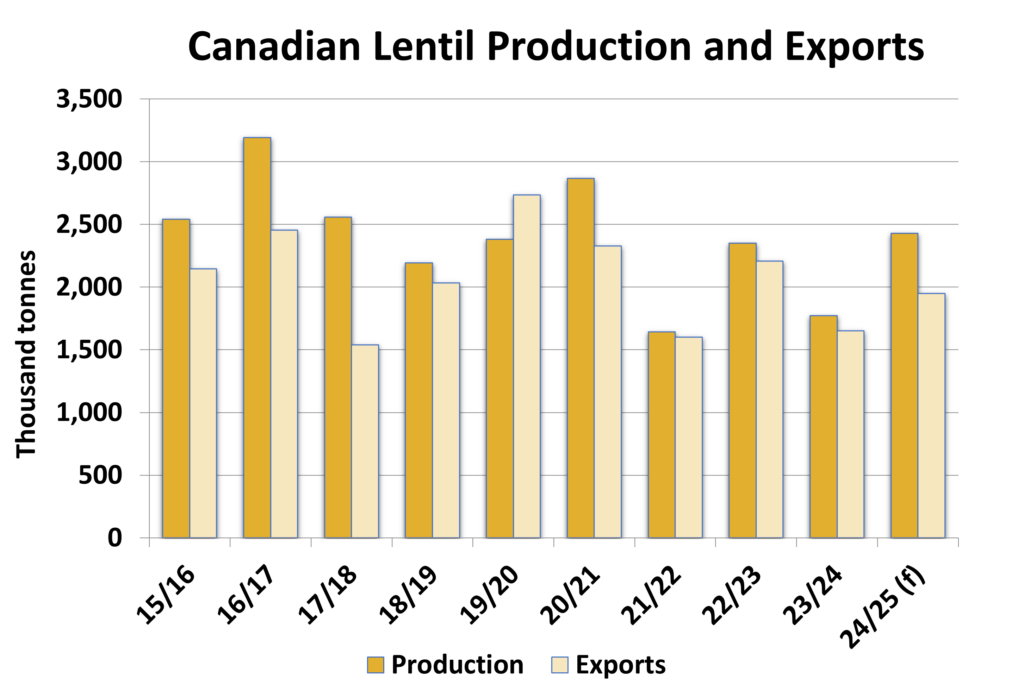

Large Lentil Production Will Lead to a Sizeable Build in Stocks

The initial Statistics Canada lentil production estimate came in at 2.77 million tonnes. This is above the LeftField projection of 2.43 million tonnes which is already up significantly from the 1.80 million tonnes grown last year. Statistics Canada does not provide a breakdown by type in this release, but previous acreage data could mean production of reds around 1.55 tonnes, up 32%, while green lentils could be approaching 900,000 tonnes, approximately 50% above 2023. The carry-out for all types of lentils is low coming into harvest, but supplies will still be up considerably in 2024/25.

It looks like export markets will be more competitive during the coming year. Australia continues to export red lentils at a near record pace, and while their production outlook for the coming year is still uncertain, it could possibly end up similar to last season. Russia’s red lentil crop looks to be up substantially in 2024, further adding to competition in global markets. Sliding prices in India and Turkey affirm a market that is well supplied for now.

The outlook for green lentils will also be challenged. Higher acres and generally good conditions in the U.S. will see production double to around 525,000 tonnes, keeping pressure on markets. Russia and Kazakhstan may also have more available supply of greens. India’s pigeon pea plantings are over 10% higher than last season while conditions look mostly favourable, potentially reducing import needs of green lentils as a substitute. When combined with the big increase in Canada, prices will remain well below the lofty levels seen in 2023/24.

Canadian Chickpea Production

The initial Statistics Canada chickpea production estimate came in at 330,000 tonnes, more than double the year-ago level and the largest since 2018. Even if the final crop size ends up a bit below this initial figure, supplies will be bigger. Chickpea stocks have been worked down in recent years, which kept the old crop carry-in manageable. Even so, Canada will need to see a larger export program in 2024/25.

One challenge for Canadian exports is the fact production in the U.S., our largest customer, will be up over 60% to around 360,000 tonnes, reducing their import needs. This means a greater emphasis is needed on offshore markets. Overseas prices have been moving higher, which may open some opportunities. Russia’s crop will be smaller than last year, although still historically large. Argentina’s planted 10% more chickpea acres this year, but there are questions around both yield and quality. The setup is such that smaller calibre Kabulis may remain relatively weaker than the larger sizes. Even if Canadian exports can exceed last year’s totals, which may be too ambitious an expectation, stocks will build during the season, which will act as a headwind for prices.

Jonathan Driedger is Vice President with LeftField Commodity Research. He can be reached at jon@leftfieldcr.com.