By Gaurav Jain, AgPulse Analytica

November 2024

The Indian government’s recent decision to increase the Minimum Support Prices (MSP) for Rabi crops for the 2025/26 marketing season has stirred expectations in the agricultural sector. Approved by the Cabinet Committee on Economic Affairs (CCEA), this substantial MSP hike, particularly for pulses, is part of the government’s strategy to boost production and address domestic food security. While this move brings optimism on the surface, its actual effect on growers’ planting decisions for this Rabi season may be limited.

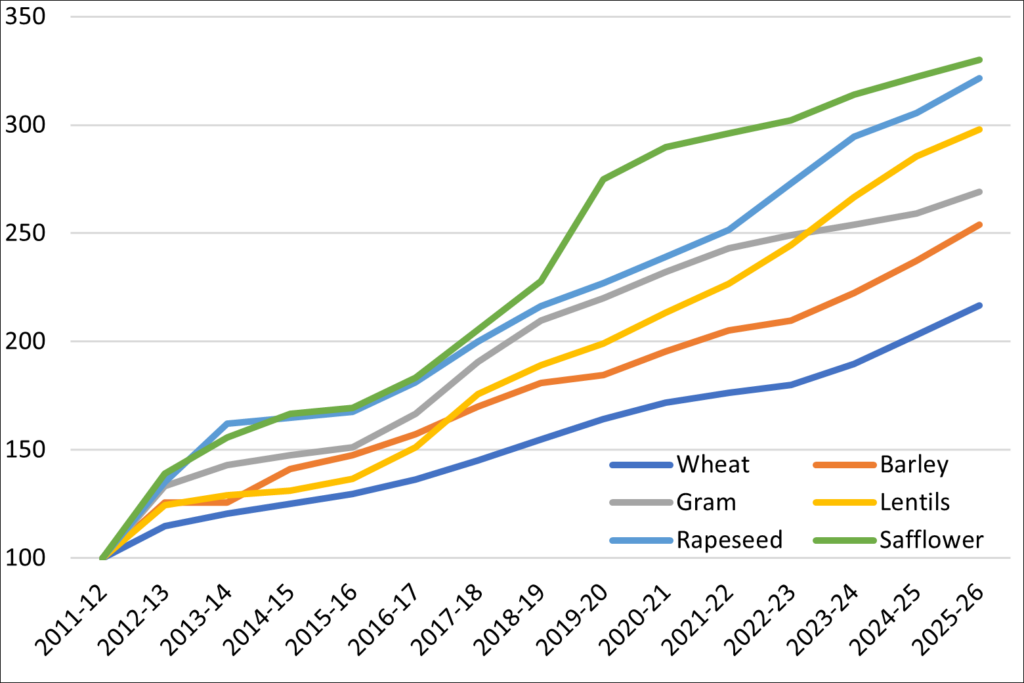

Historical Trends in MSP and Pulses Production

Over the past 15 years, safflower (a minor crop by volume) has experienced the steepest MSP increase, while wheat, the largest Rabi crop, has seen more conservative hikes. Chickpeas (also known as gram), a staple pulse in India, experienced a sharp rise in support prices during the middle of the last decade. However, further increases have been sluggish compared to the significant hikes seen for lentils.

Relative Increases in Rabi Crops MSP

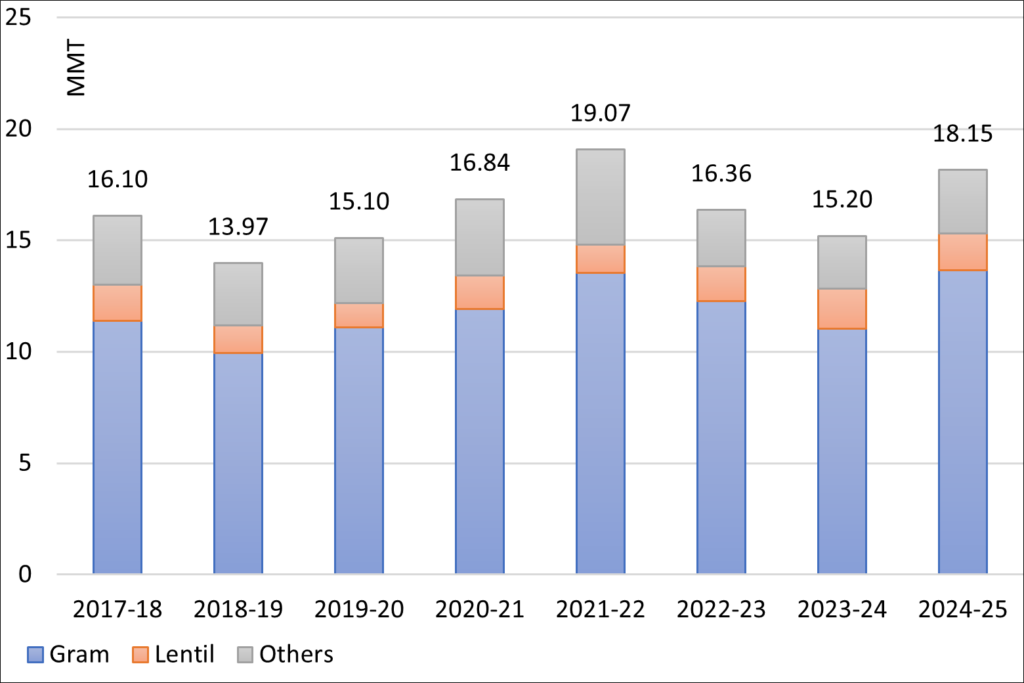

While the MSP increase aims to influence planting decisions, market prices are likely to have a greater impact on farmers’ choices this season. Despite the government setting ambitious production targets of 18.15 million tonnes of pulses (including 13.65 million tonnes of chickpeas and 1.65 million tonnes of lentils) for the 2025 Rabi harvest, this will only materialize if farmers are incentivized to plant these crops.

Rabi Pulse Production

Market Conditions Driving Planting Decisions

In the past two Rabi seasons pulse acreage has been on a downward trend, with chickpeas being the most affected crop. However, last season, lentil acreage reached an all-time high as farmers shifted focus to the crop. Unfortunately, duty-free imports significantly undercut Indian lentil farmers’ profitability, while the supply-demand gap in chickpeas helped maintain strong returns for growers. This difference in market conditions is expected to shape planting choices this year.

Chickpeas have been highly remunerative for Indian farmers over the past year. Despite a shift in policy allowing duty-free imports of desi chickpeas, domestic prices remained elevated, which means that many farmers will likely increase their chickpea acreage this season. Additionally, chickpeas fit well within typical crop rotation plans, further supporting this choice.

In contrast, lentil prices have mostly remained below MSP throughout the season and government procurement has been weak, leading to a lack of incentive for lentil planting. As a result, lentil acreage may decline this year, especially in key state of Madhya Pradesh, where farmers may shift to more profitable crops.

Procurement Challenges and the Need for Imports

The MSP hike for two of the most procured Rabi crops, wheat and chickpeas, was lower than expected, and the new MSP levels are far below the prevailing market prices. This price differential could create challenges for government agencies like FCI (Food Corporation of India) and NAFED (National Agricultural Cooperative Marketing Federation of India), which are tasked with procuring these crops post-harvest. If the gap between MSP and market prices persists, the government may struggle to acquire the quantities required to stabilize prices and ensure adequate availability in domestic markets.

Given the low stock levels of pulses with these agencies, the government may have no choice but to turn to imports as a solution. We can expect continued duty-free imports of lentils and possibly chickpeas and yellow peas to fill the gap left by domestic shortfalls. The demand for imported lentils may, however, remain moderate, as the revival of the domestic pigeon pea crop and potential liquidation of NAFED stocks may reduce the need for substantial imports.

Conclusion

While the Indian government’s MSP hike sends a positive signal, market realities—specifically price trends—will have the final say in shaping Rabi pulse acreage. The chickpea crop, given its profitability, may see increased acreage, but lentils are likely to lose ground due to weak market prices. To meet domestic demand, imports will remain a critical factor, and the government may need to maintain or even expand duty-free import policies for pulses like yellow peas, chickpeas, and lentils.

For the global market, particularly for countries like Canada, Russia, and Australia that export pulses to India, this signals a continued opportunity to supply Indian markets, as domestic production may not fully satisfy demand.

Gaurav Jain is the founder and chief analyst at AgPulse Analytica, based in New Delhi. He can be reached at gaurav@agpulse.net