By Marlene Boersch, Mercantile Consulting Venture Inc.

January 2026

Welcome to the markets of 2026. It is going to be another interesting year, influenced by global politics and trade disputes. Political interference in our ag markets commonly has complex effects, leading to both intended benefits (food security, supporting farmer incomes) and negative consequences (market distortions, reduced efficiency, and trade disputes). The ultimate impact depends on the specific policies implemented and the broader economic context. Canada has tended to be on the receiving end of tariffs, and over the past year, it has been pummeled by actions by the two most prominent players in ag trade, the United States (U.S.) and China. Instead of simply following others’ lead or being influenced by competing interests, we need to act thoughtfully and develop our own strategy and objectives—rather than just adopting external policies, such as tariffs on Chinese electric vehicles. It remains to be seen how Canada will extricate itself from being squeezed/used by the U.S. and China, and the policy effects of our previous decisions threaten to linger into the next crop year. Below is an outlook for the Canadian pea and lentil markets based on the intelligence available at the start of the year.

Peas

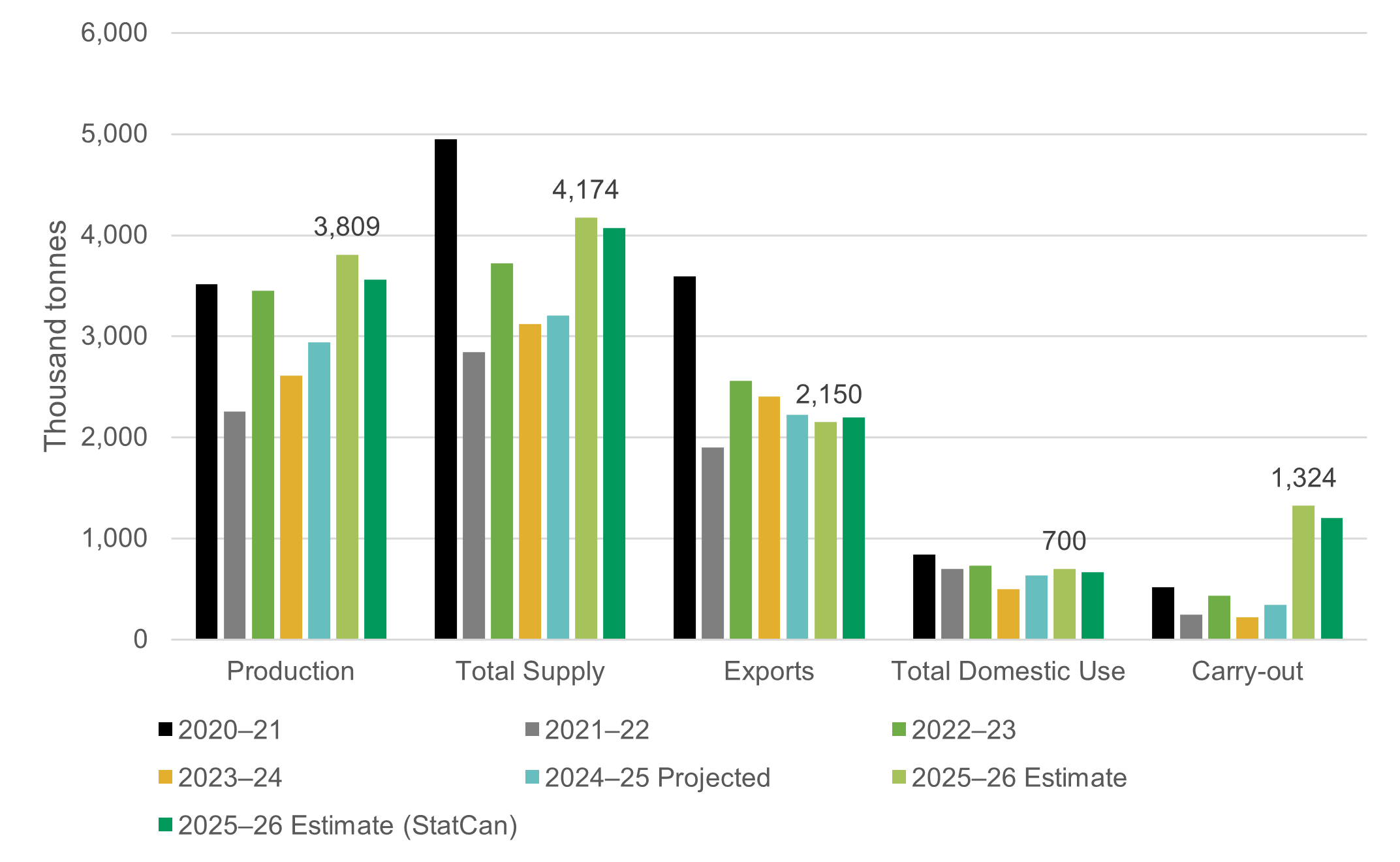

Pea fundamentals have changed profoundly over the past year for two main reasons: First, the yields and production outcomes for peas in 2025 were excellent, not only in Canada but also in other major production areas. Statistics Canada’s (StatCan) final estimate of Canadian pea production came in at 3.9 million (M) tonnes, 31% higher than the previous year (+1 M tonnes). The Canadian pea supply looks to be ~1.2 M tonnes bigger than last year’s.

Canadian Pea Balance Sheet

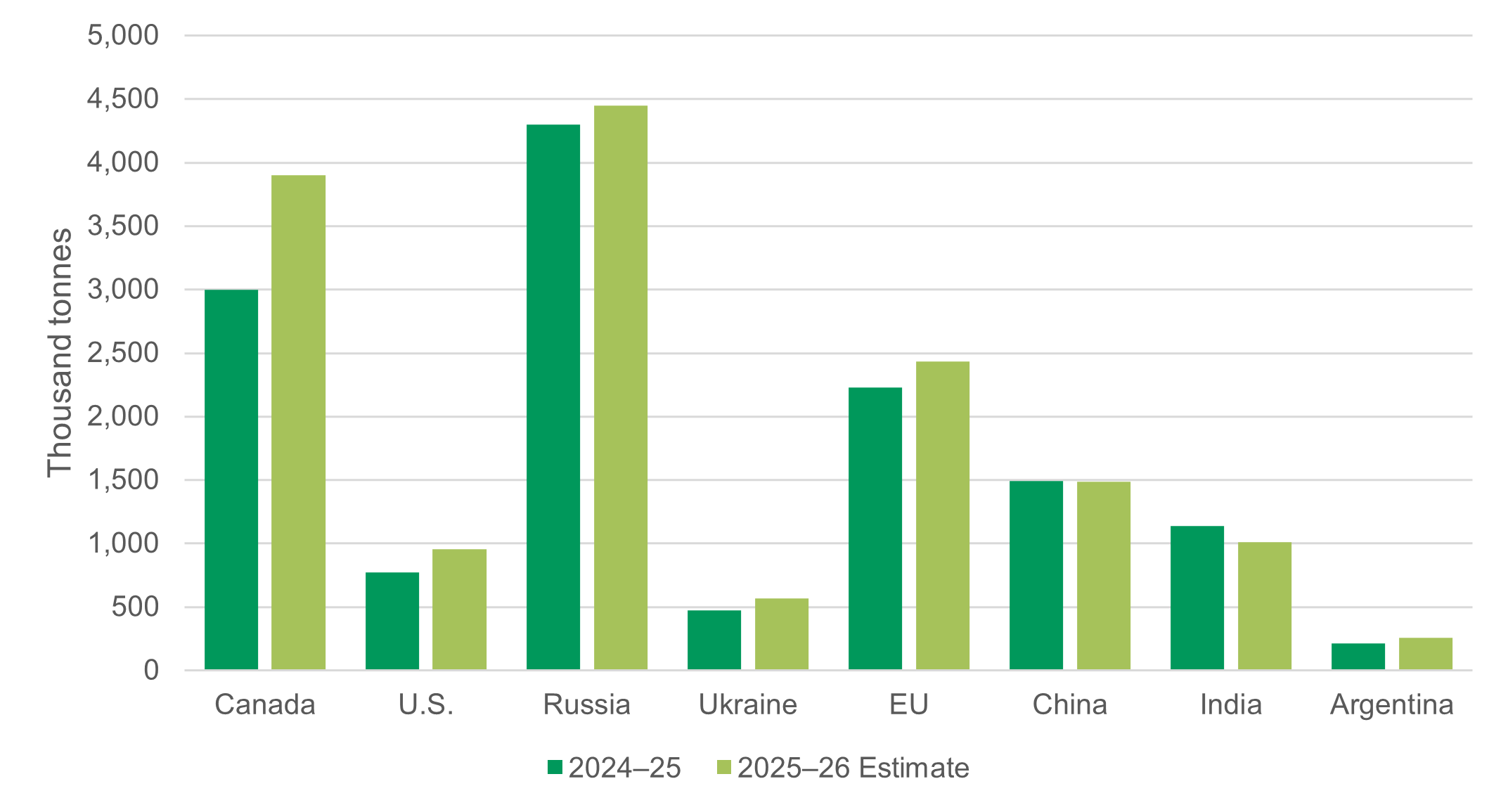

Similarly, we estimate global pea production in 2025 (major producers) at 15.1 M tonnes, up 11% from 13.7 M tonnes in 2024. The main increases were in Canada, Russia and the European Union (EU).

Global Pea Production: Major Producers

This means that the production and supply side of the equation is excellent this year. Peas have seen fairly solid global demand. However, especially on the Canadian side (and this is the second point), demand has been diluted by a) increased competition from Black Sea producers in Asian markets, and b) significant trade barriers, chiefly from China and, to some extent, India.

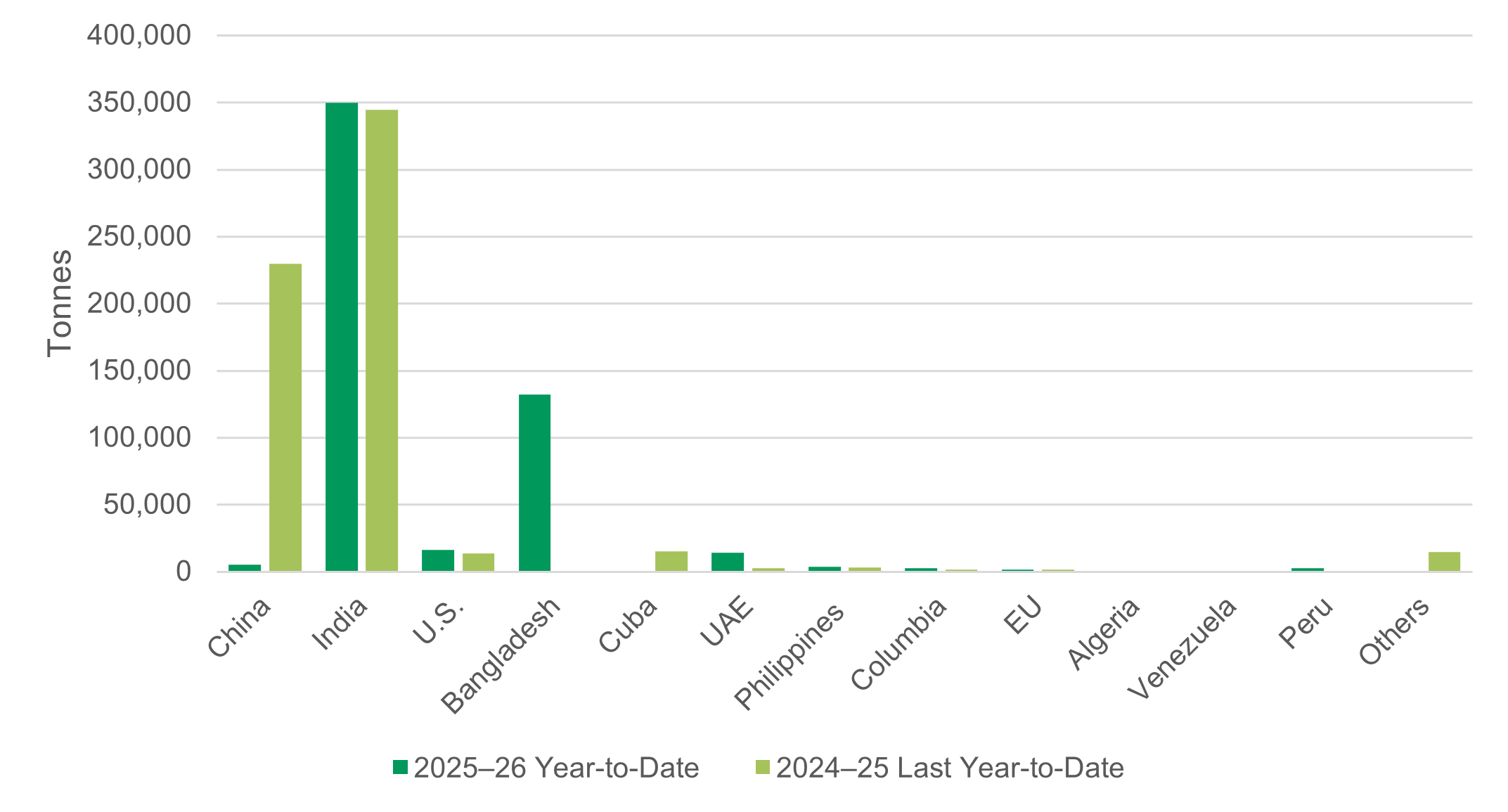

Year-to-date Canadian bulk exports at 1.1 M tonnes are down 14% (-168k tonnes), and the latest StatsCan export numbers, including container shipments (Sept.), point to a 9% decrease in exports due to the significant reduction to China.

Year-to-Date Canadian Pea Exports by Destination

Given these circumstances, we anticipate that the Canadian government will take action in response to issues with China, specifically concerning peas and canola. We expect the January trip planned by Prime Minister Carney will aim to address Canada’s electric vehicle tariffs and help reopen the Chinese market. Mercantile is currently using a 2.15 M tonne export figure for Canadian peas, which includes 600k tonnes to China. Russia has become the largest exporter of peas to China, though Chinese buyers prefer Canadian-quality peas. If our export target is met, this would be only 75k tonnes smaller than the 2024–25 pea export volume, but it would not show an increase relative to this year’s higher production.

The net result will be significantly increased ending stocks, especially in Canada. Given the above export number, Canadian pea ending stocks would rise to 1.36 M tonnes, a dangerously big 48% stock-use ratio. Should Canada be able to export more, then the stock-use ratio would drop accordingly.

The main problem with a large carry-out is its effect on the outlook for the next crop. Buyers do not feel the need to secure next year’s supplies and are hesitant to entertain production contracts. In addition, problems emerging during the growing season will have a more muted effect on price, because everyone knows there is a supply cushion.

Prices for peas have been relatively stable over the fall at ~$7–7.50 per bushel (bu) for yellows, and ~$10–10.50/bu for good greens. We expect prices to remain sideways into spring. At this point, we do not expect aggressive bids for new crop peas. Bunge is currently bidding $6.10/bu for August to September 2026. Mercantile thinks this is too low.

Lentils

Canadian lentils mirror the problems in the pea market, except that the primary focus of the trade challenges is with India. Again, at least the government is actively attempting to ameliorate our trade relations with India.

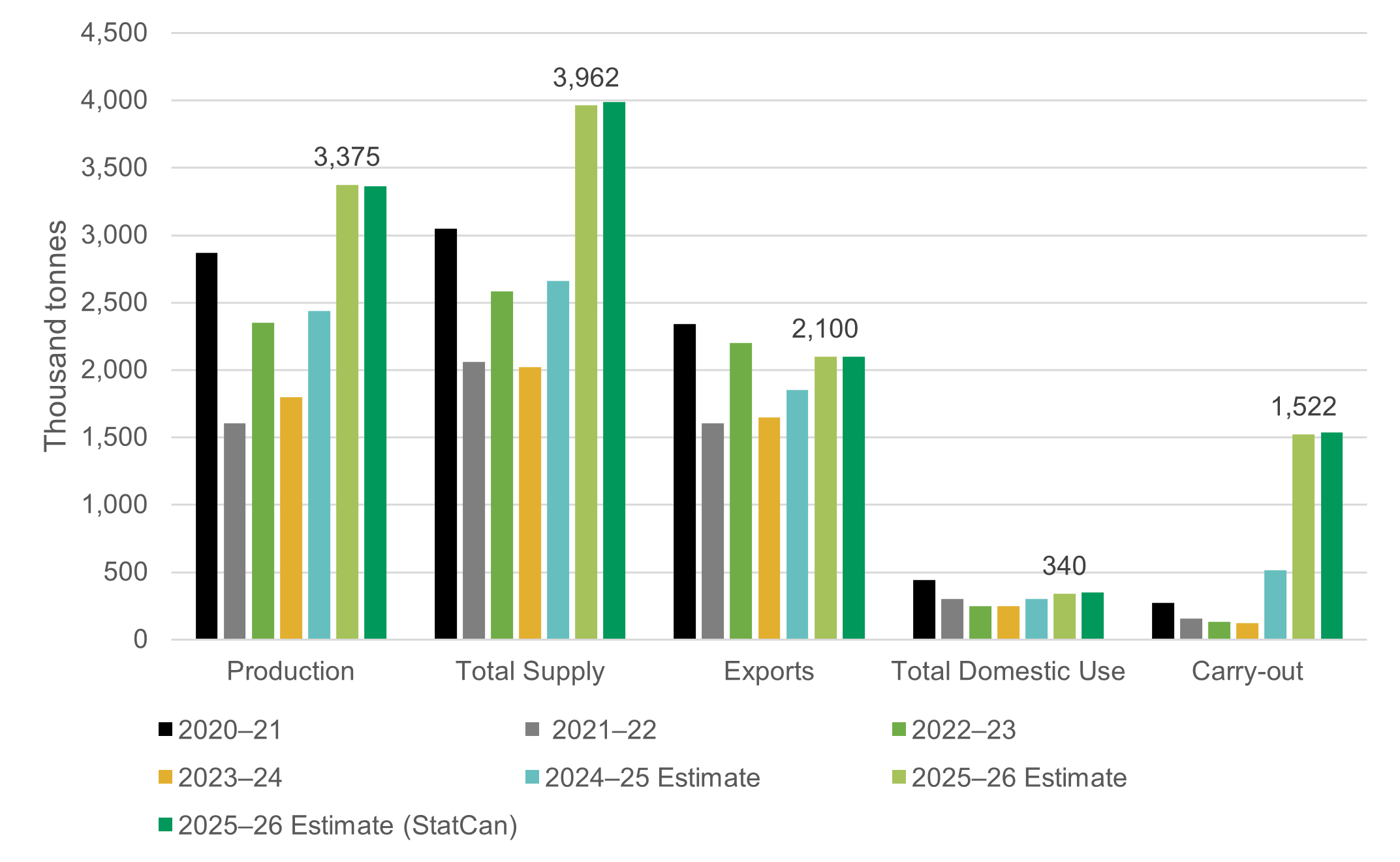

Regarding fundamentals, the lentil supply-and-demand picture has loosened substantially. Canadian lentil production this year was pegged at 3.36 M tonnes, a 38% increase over the previous year. Supply has risen to just below 4 M tonnes, a 48% increase (+1.3 M tonnes).

Canadian Lentil Balance Sheet

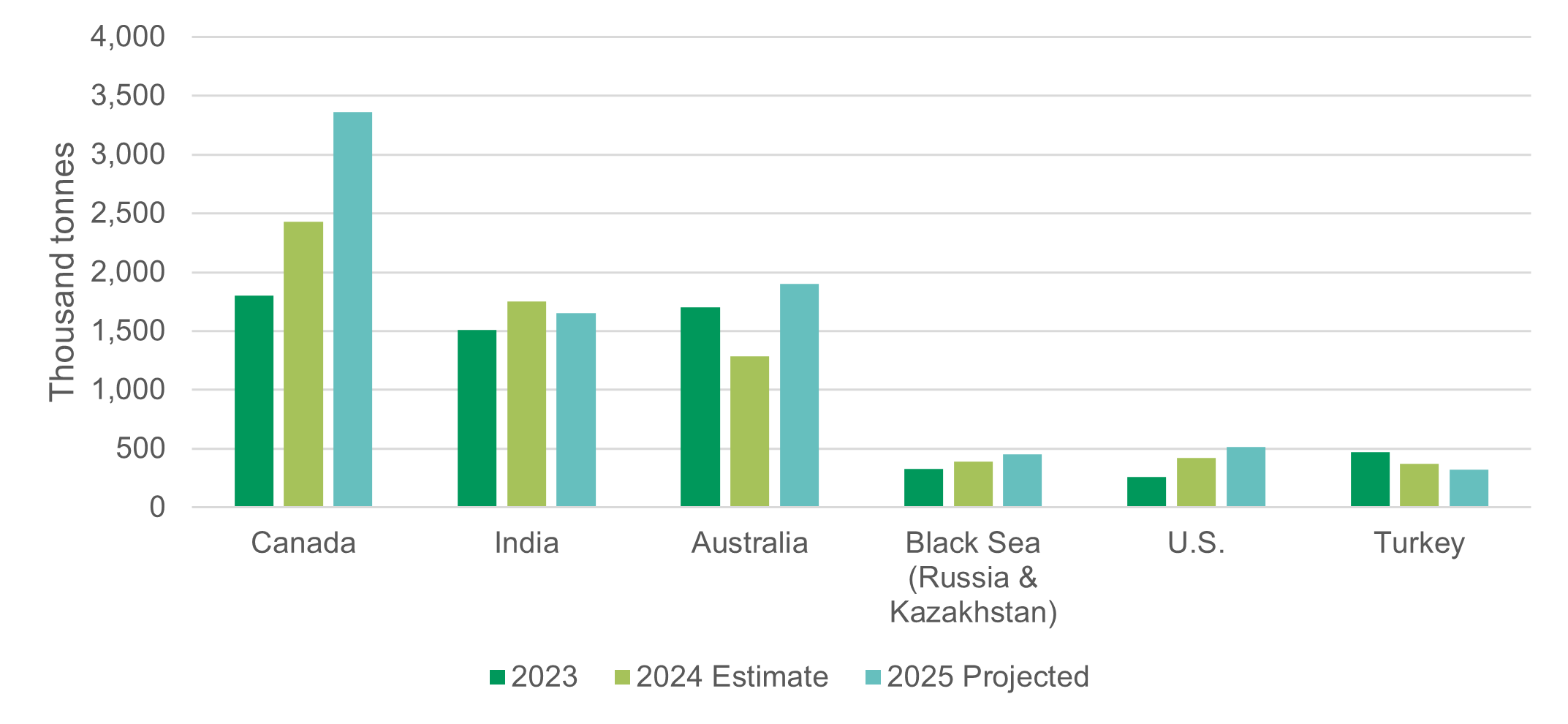

Similarly, global lentil production is expected to increase by about 23% (+1.5–1.6 M tonnes), primarily due to increases in Canada, Australia, and the Black Sea region.

Global Lentil Production: Major Producers

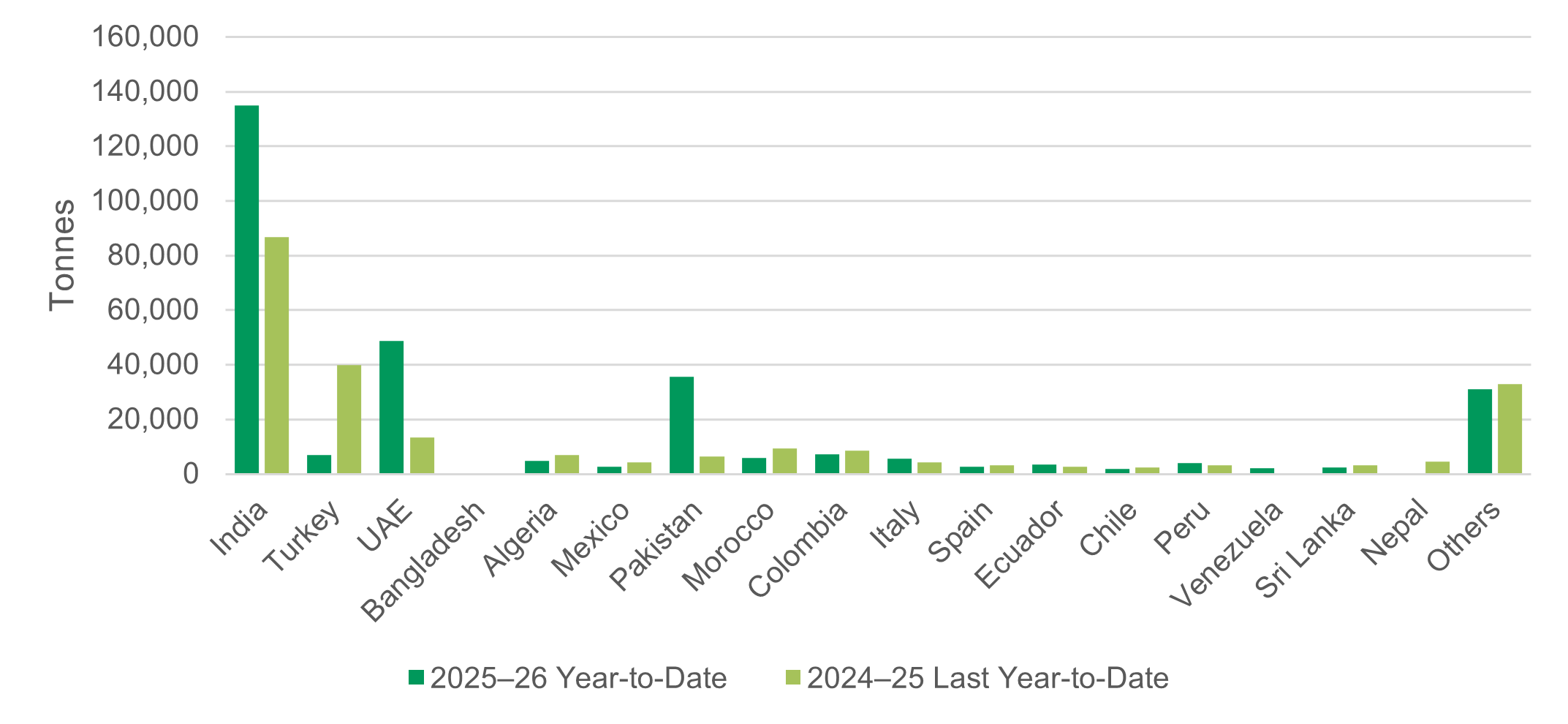

On the demand side, the Canadian Grain Commission bulk export numbers for Canadian lentils at 605k tonnes (as of week 20) show exports 1% ahead of last year’s. And the StatCan export numbers, including container shipments at 301k tonnes, showed August to September exports 29% (+68k tonnes) ahead of last year’s. Regarding destinations, year-to-date exports to India and the United Arab Emirates (UAE) are up significantly, while exports to Pakistan are also up. Exports to Turkey, often the second-largest destination for Canadian lentils, are down considerably. This is due to increased lentil imports by Turkey from Kazakhstan and Russia. For the crop year, Mercantile is using a 2.1 M tonne export figure for lentils, which is 13.5% higher than last year’s exports. However, because of the significant production outcome, Canadian ending stocks would still be 1.5 M tonnes, a substantial 62% stock-use ratio.

Like for peas, the large ending stocks will dampen the desire of exporters/buyers to contract lentils at attractive prices, and weather problems during the growing season will have a more minor impact on values as well.

Year-to-Date Canadian Lentil Exports by Destination

That said, we do not consider the global red lentil market to be seriously oversupplied. Canada’s red lentil crop was up only a little (~1.8 M tonnes vs. 1.7 M tonnes last year; no more than 100k tonnes over the previous year’s), and while Australia has just harvested a good crop (1.9 M tonnes), the Turkish lentil crop was seriously curtailed. Given the lower export prices this year (which are working well into most bulk markets), markets should keep red lentils fairly balanced. The downside risk for red lentil prices is limited.

Green Lentils

However, given the good U.S. and Canadian crops and perhaps ~500k tonnes of green lentils from the Black Sea (Russia and Kazakhstan), the greens market is much more seriously oversupplied. Canadian greens likely add ~1.7 M tonnes, up from ~750k tonnes last year. And high container prices from Canada are not helping to get to markets competitively. Canada will need the Indian market take volume greens, or ending stocks will be burdensome indeed. Green lentil values are vulnerable, and it is tough to see green lentil prices appreciate. And come spring, the problem of colour deterioration from one year to the next will become a factor as well.

Marlene Boersch is a managing partner in Mercantile Consulting Venture Inc. More information can be found at www.mercantileventure.com.