By Gaurav Jain, AgPulse Analytica

June 2025

Australia’s pulse industry is primed for a robust 2025/26 season driven by strategic crop planning, favourable trade dynamics, and strong global demand. Chickpeas, lentils, and peas are key export crops with India, Bangladesh, and China as primary markets. This analysis, combining AgPulse Analytica forecasts with market insights, highlights the production outlook and opportunities for Australian pulses in a competitive global landscape.

Chickpeas: Capitalizing on India’s Deficit

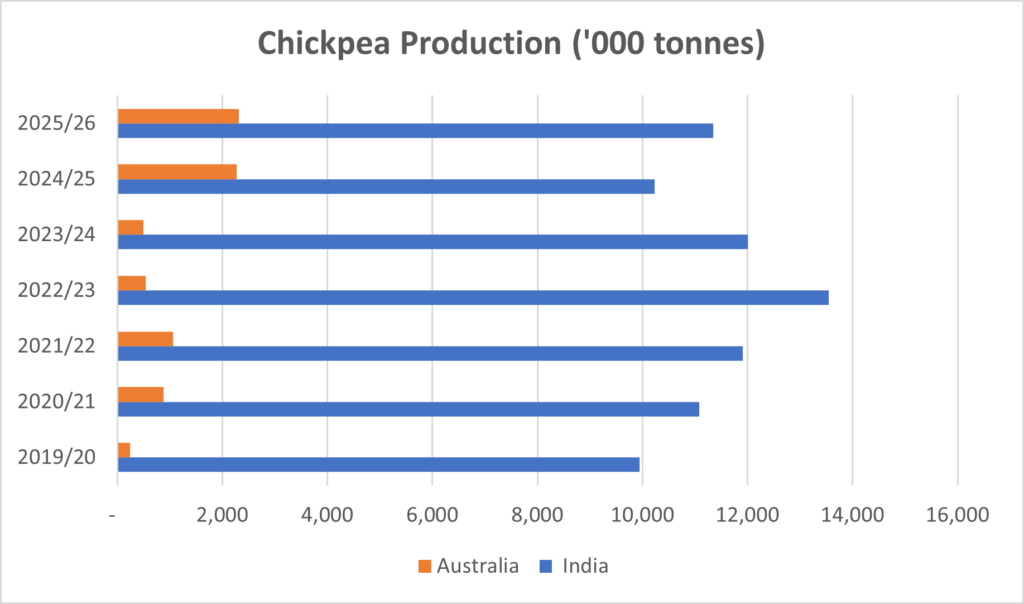

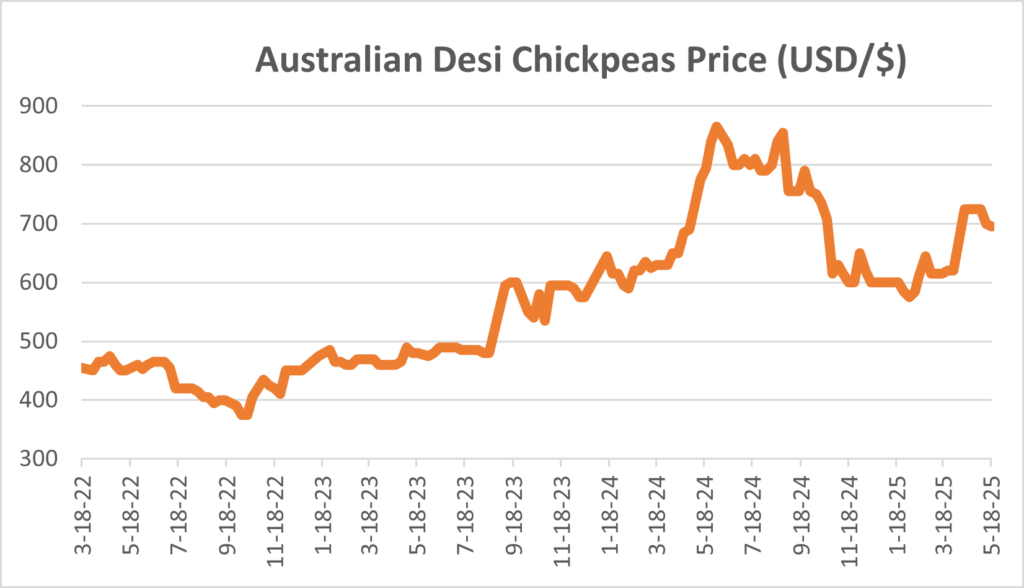

Chickpeas are a cornerstone of Australia’s pulse exports, with India as the dominant market. India’s chickpea production fell from 13 million tonnes in 2022/23 to 9 million tonnes in 2024/25 due to persistent dry conditions in regions like Madhya Pradesh. With an average consumption of 12 million tonnes, the 3 million tonne deficit has fuelled demand for Australian chickpeas, driving prices upward. In 2024, Australian farmers expanded plantings to near-record levels, second only to the 2016/17 drought-driven surge, with over a million hectares allocated due to favourable soil moisture in New South Wales and Queensland. AgPulse Analytica projects the Indian chickpea crop to recover to 10 million tonnes in 2025/26, still leaving a 2 million tonne shortfall. Australia’s forecasted 2.3 million tonne crop is well-positioned to meet this demand, supported by satisfactory weather conditions. The September/October harvest aligns with Ramadan (February/March 2026), a period of heightened consumption in South Asia, offering premium pricing. Demand from countries like Bangladesh further bolsters export prospects.

Lentils: Addressing Production Challenges

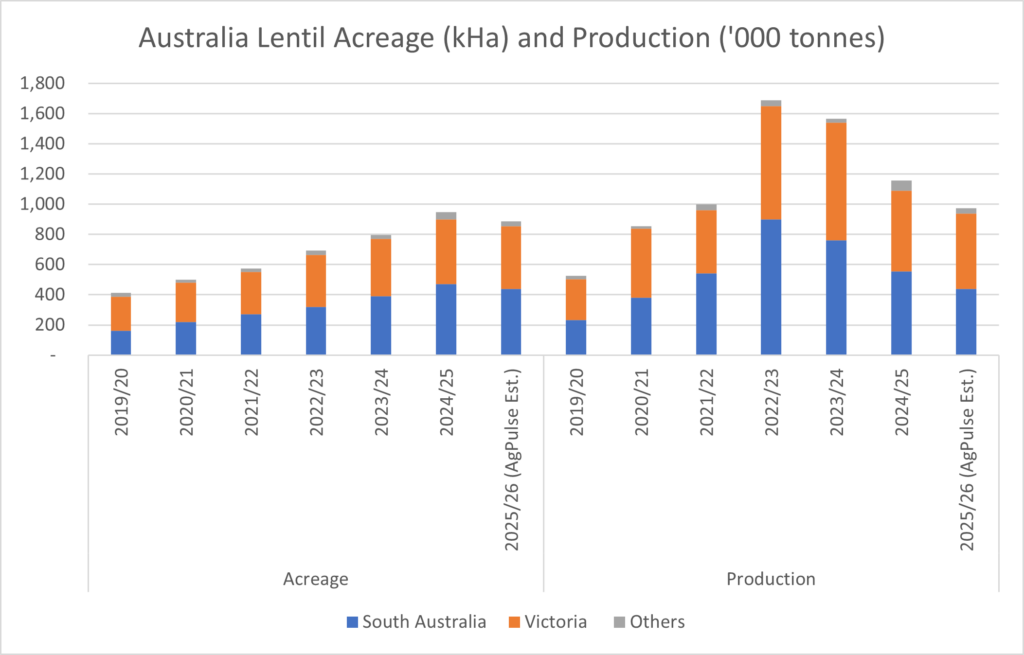

Lentils are a vital crop for Australia, with production centred in South Australia and Victoria. In 2023/24, Australian farmers expanded lentil acreage in response to high prices driven by Indian pigeon pea (Tur) shortage, which increased lentil demand. However, India’s improved Tur crop in 2024/25 has stabilized markets, leading farmers to limit lentil plantings for 2025/26.

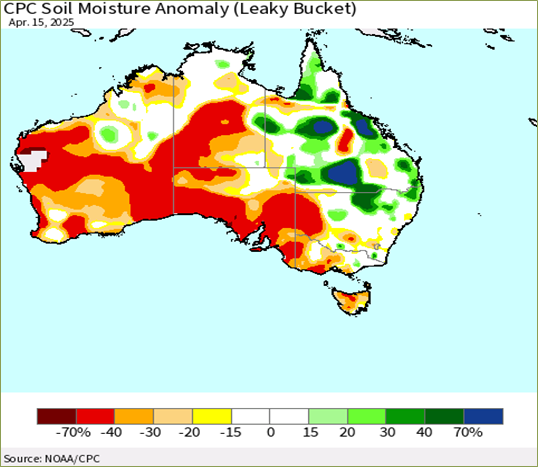

AgPulse Analytica estimates a 10% reduction in lentil acreage compared to 2024/25, reflecting cautious planting decisions amid challenging conditions. Extremely dry soil in South Australia and ongoing dryness in Victoria are likely to constrain yields, potentially reducing production below 1 million tonnes. Despite these challenges, Australia’s high-quality red lentils remain competitive, with steady interest from Bangladesh and other South Asian markets. Investments in drought-resistant varieties and improved irrigation could help stabilize future production, ensuring Australia meets regional needs.

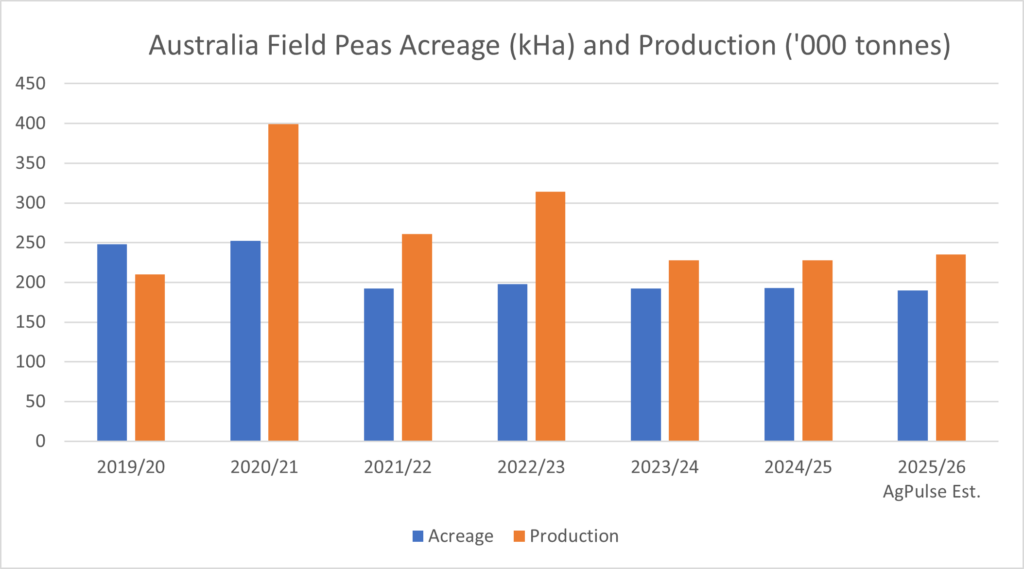

Peas: Seizing Opportunities in China

Field peas are gaining traction, with China as a key importer. In 2024/25, India’s chickpea deficit led to pea substitution, reducing China’s imports. For 2025/26, India’s improved chickpea and pea crops will likely ease its import needs, boosting China’s demand.

China’s 100% tariff on Canadian peas has opened doors for Australia. Though they have a shipping advantage, however prospects for 2025/26 Australian peas are not very different from last year.

Conclusion

Australia’s pulse industry is set to thrive in 2025/26, leveraging strong chickpea production, resilient lentil output despite acreage constraints, and growing pea exports to China. While dry conditions pose challenges, Australia’s strategic advantages—timely harvests, high-quality crops, and proximity to Asian markets—ensure a robust global position. In a competitive landscape, Canada and other pulse-producing nations continue to play a significant role, contributing high-quality pulses to meet global demand with innovation and reliability.

Gaurav Jain is the founder and chief analyst at AgPulse Analytica, based in New Delhi. He can be reached at gaurav@agpulse.net