By Jon Driedger, LeftField Commodity Research

February 2025

Rarely has there been a time when Canadian grain markets simultaneously faced so much policy uncertainty on multiple fronts. India’s tariffs on pulse imports are regularly something Canada is forced to navigate. In the fall, China announced an antidumping investigation on Canadian canola, with the expectation that tariffs would come at some point in the future.

More recently, President Trump’s election in the United States (U.S.) brought on the prospect of widespread import tariffs on Canadian goods. When we consider Canadian pulse exports, the focus is primarily on overseas markets, so it’s easy to overlook that the U.S. has been the third-largest customer for Canadian pulses since 2021. It is important to understand the role of the U.S. as an export market, given the current risks.

The U.S. a Small, But Important, Share of Canadian Pea Exports

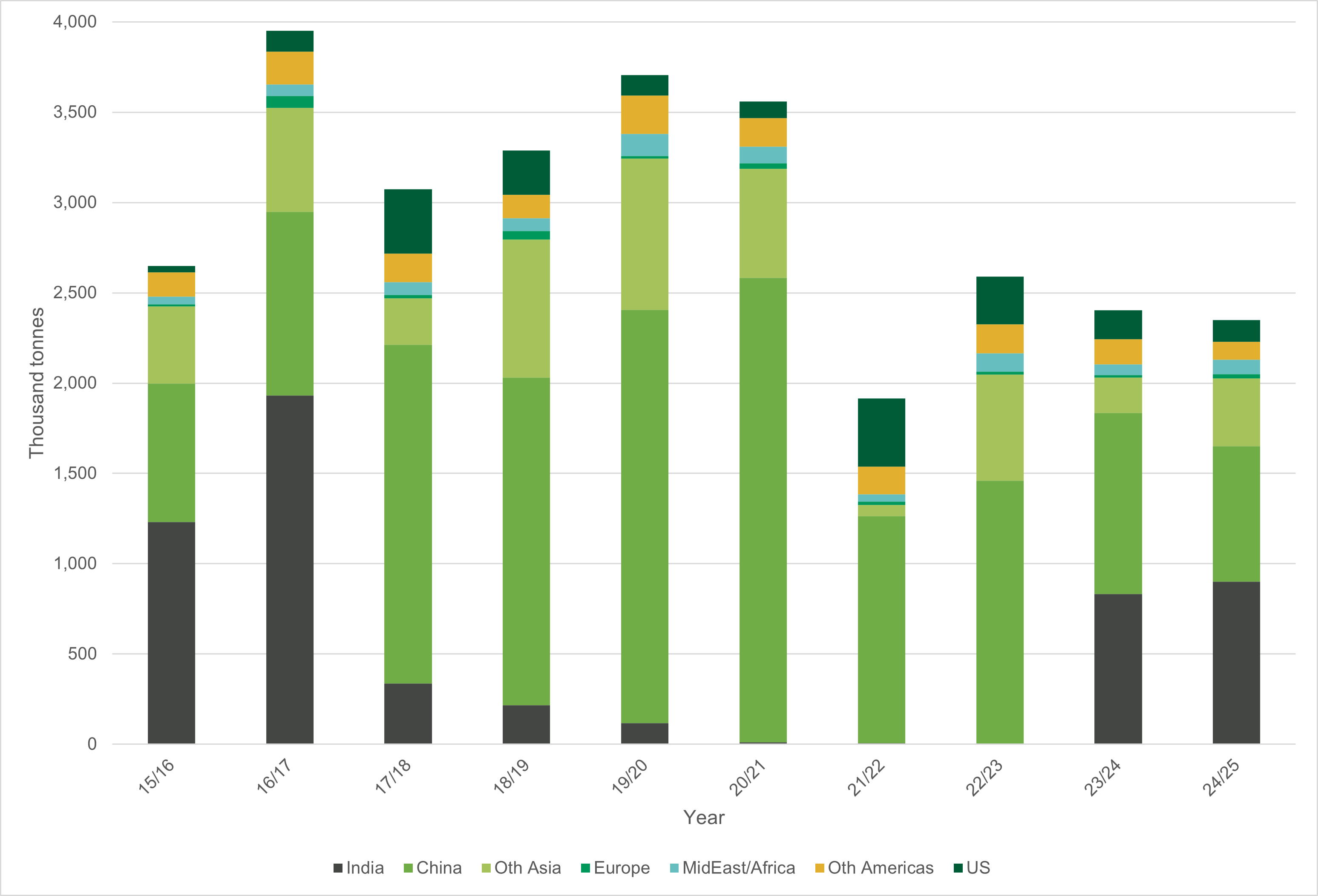

Canada’s pea exports overwhelmingly go to China and India (in years when India does not have import tariffs). The U.S. share of Canada’s exports tends to be around 10%, depending on the year. The recent high for shipments was the drought-impacted 2021/22 season when Canada sent 377,000 tonnes after U.S. pea-growing regions faced similar conditions to much of Western Canada. Otherwise, exports are between 100,000 and 250,000 tonnes out of total Canadian exports of around 2.0 to 2.6 million (M) tonnes.

Canadian Pea Exports by Destination

While U.S. purchases are not that large in total Canadian pea trade, the market might be forced to ‘buy demand’ into other markets at lower prices to move any potential lost U.S. business, such as competing with Russian peas for feed usage into China. This could result in a price impact for farmers that is more extensive than what the portion of U.S. trade might indicate on the surface.

Lentils May Be Less Impacted Than Other Pulse Crops

Lentil exports to the U.S. account for 5% or less of total shipments, averaging around 80,000 tonnes in the past few years. If tariffs are imposed, lentils will be among the least impacted Canadian crops. Canada’s overall export customer base is also highly diverse, which helps buffer the impact of any lost lentil shipments to the U.S.

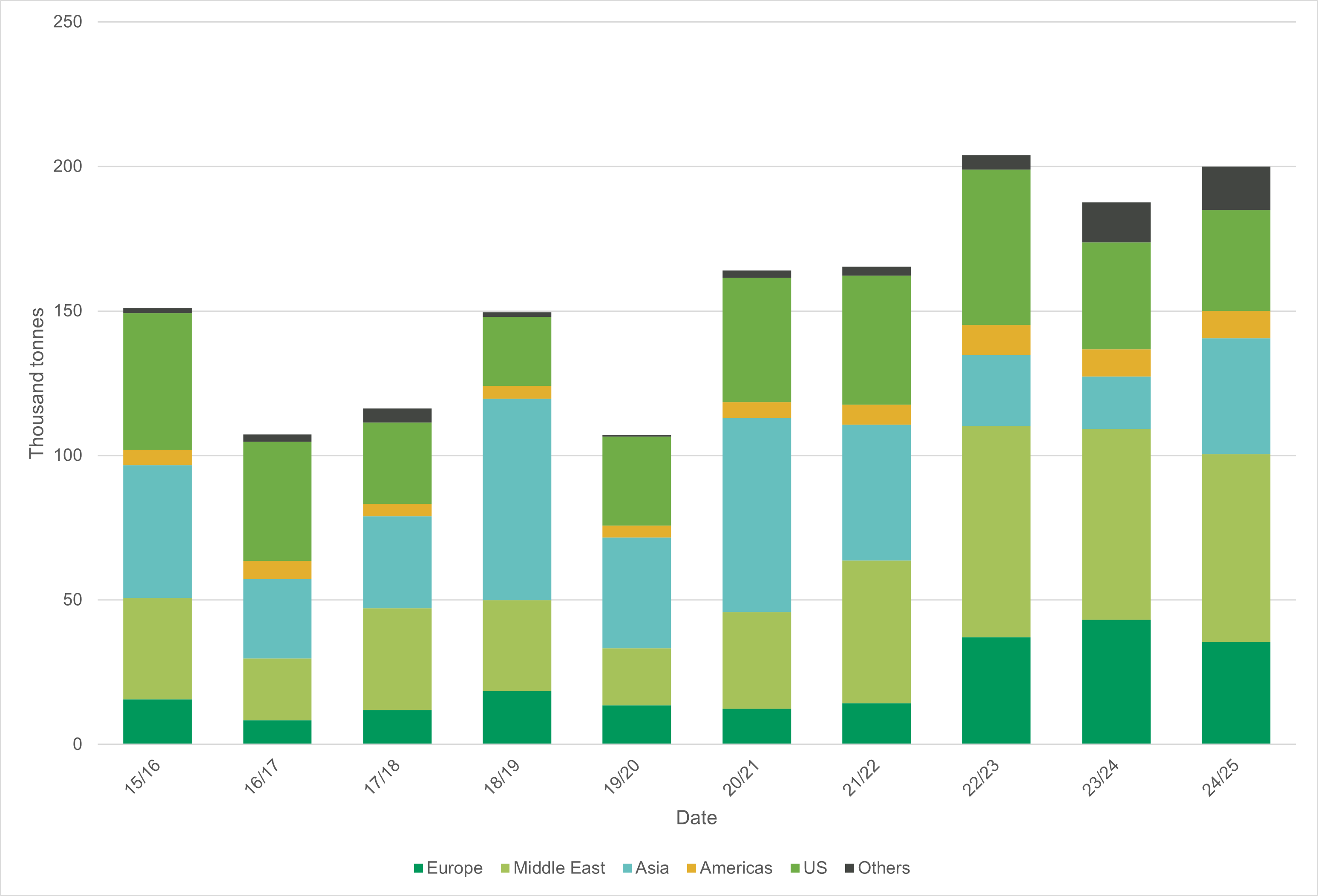

Chickpeas Possibly the Pulse Crop Most Impacted

Chickpeas may be the pulse crop most vulnerable to U.S. tariffs. The U.S. typically has a larger share of total Canadian chickpea exports and has been the single biggest market, at 20–30% of total annual shipments and around 35,000 to 50,000 tonnes, as product flows into both the human food and pet food markets., The close proximity also makes the U.S. a particularly important customer. A loss of this market would force Canada to try moving additional supplies into more competitive global export channels, likely at a lower price to the grower.

Canadian Chickpea Exports

Dry Beans Highly Reliant on the U.S. Market

Roughly 30% of Canada’s dry bean exports go to the U.S., averaging just over 100,000 tonnes annually in the past few seasons, making it the single largest destination. Black and pinto beans make up a significant portion of the trade, putting those classes at greater risk than others that send a smaller share of their shipments to the U.S., although at least a portion of all types of dry beans flow south. U.S. tariffs also threaten Mexico, and any retaliatory actions on their part could open some opportunities for Canada to increase dry bean exports into that country.

Canada is an Important Export Market for the U.S. as Well

Our natural inclination is to think about potential lost Canadian business to the U.S. primarily, but there would likely be negative implications for the U.S. pulse industry. The U.S. is a key export market for Canada, but Canada is also the largest export market for U.S. pulses. Whether in the form of retaliatory tariffs by Canada, pulse prices declining in Canada in response to U.S. import tariffs, or unforeseeable knock-on effects of slower trade with the U.S., U.S. exports of pulses into Canada would likely slow sharply as well. Any disruption of two-way trade between the countries negatively affects the North American pulse industry.

Longer-Term Risks to Consider

The possible immediate loss of exports would be challenging for the pulse industry. Still, the greater threat is the longer-term implications if disruptive tariffs remain in place for an extended period. This is particularly the case if the loss of Canadian supplies sends a price signal to U.S. farmers to increase acres, potentially setting up a structural shift to higher plantings. While not tariff-related, we see an example of this with chickpeas in the current season, where a larger U.S. crop has resulted in lower imports from Canada in 2024/25.

Canadian pulse exports rely less on the U.S. market than other crops where the bulk of shipments move south. Even so, reduced demand from any market negatively affects prices, while the overhang of uncertainty further adds to the various challenges for Canadian farmers and the grain industry.

Jonathan Driedger is Vice President with LeftField Commodity Research. He can be reached at jon@leftfieldcr.com.