By Jon Driedger, LeftField Commodity Research

February 2024

The calendar says the 2023/24 season is only at the halfway point, but for many farms the marketing year is nearly over, as most of the crop is either shipped or committed. Attention is now increasingly shifting to the 2024/25 season. Of course, it is impossible to predict what new crop markets will look like since it is still months away from seed even getting in the ground, and particularly with dryness remaining a concern across much of the Prairies. We can start to consider some scenarios, however, by assessing the current old crop status, contemplating what plantings may be this spring, and identifying key factors to monitor that remain unknown but have the potential to shape market direction in the year ahead.

Outside Influences Could Be Impactful

Before looking at specific pulse crops, it is important to examine the larger backdrop and consider factors that will affect the grain complex as a whole.

Pulses can, at times, be somewhat of an ”island” within broader grain markets due to the nature of where they are largely grown and, perhaps more importantly, their demand structure. This allows for periods where prices for specific pulses trade higher when most other crops are moving lower (and vice versa), something witnessed this season.

But they are not completely immune to the behavior in other markets. When pulses are relatively high there is the incentive for demand substitution where possible, whittling away some usage around the margins, while simultaneously encouraging larger plantings. Many cereal and oilseed markets are currently trading at their lowest point in several years, and prospects for any turnaround are uncertain. This may provide headwinds for upside price potential in pulses.

This year will be historic for the number of elections taking place around the world. Most of them will have little effect on pulse markets directly, but they may influence the broader macroeconomic environment, including foreign exchange rates and trade legislation. Specifically relevant for pulses, India has important elections in April and May that could shape import policies in this enormously significant market.

Logistics are critical to all markets, and always prone to challenges. Often this is more regional in nature, such as adverse weather in Western Canada impacting rail movement to Vancouver. The past few months have seen disruptions to major global shipping routes, however, including low water levels slowing the flow of ships through the Panama Canal and unrest around the Red Sea. This is driving up costs and shaping trade flows.

Pea Outlook Largely Hinges on Policy

The balance sheet for yellow peas was never projected to be heavy, but also did not seem likely to be particularly tight until India dropped import restrictions on peas. The subsequent increase in export demand caused prices to jump and will end up drawing stocks down to a very low level. The green pea market has been tight all year as small supplies and steady export demand drove prices to record levels.

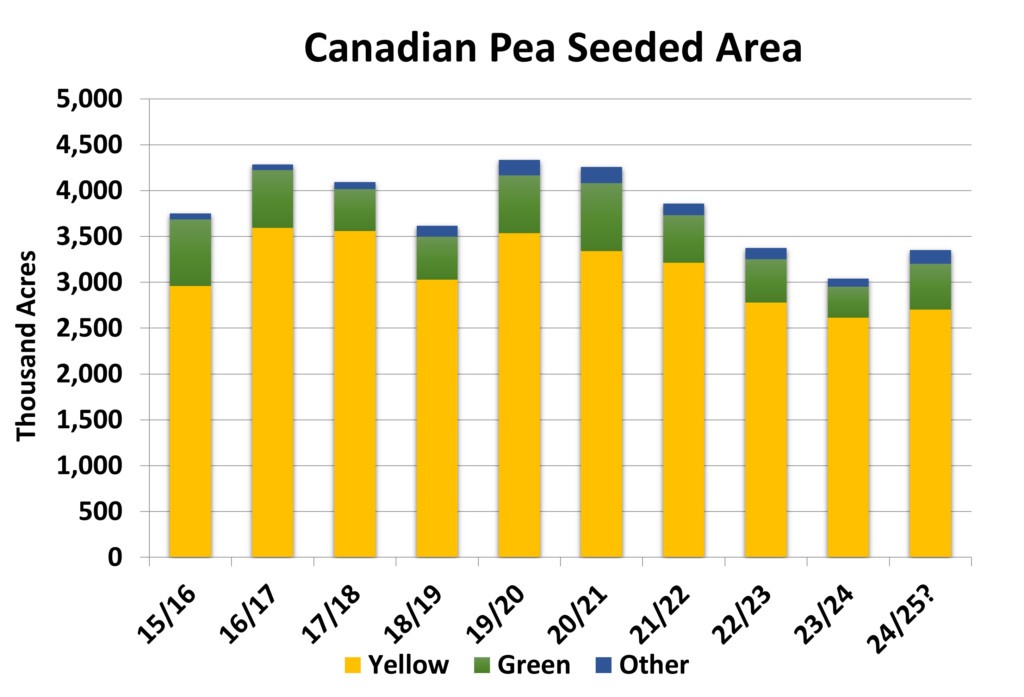

New crop prices offered to farmers are well below old crop values, but Canadian pea seeded area is still projected to be higher in 2024, perhaps by 10%. Yellow pea acres may see a small bump from the 2.6 million planted last season, but remain near the lowest in a decade, and sets up for supplies to be relatively small again. However, that does not automatically mean a strong price outlook as other countries have also become important players in global markets. This shows up, for example, in larger Russian shipments to China, which had previously taken most of their peas from Canada.

More important is whether India will extend the window for the removal of import restriction on peas beyond the March 31, 2024 deadline, something unknown at the time of writing. If extended for a meaningful period of time, possible large purchases from Canada could see stocks drawn down to minimum levels again in 2024/25 despite the larger production. However, if tariffs are reinstated at the same time other countries add to global supplies, yellow pea prices will likely move lower.

Green pea acres will see most of the increase in acres as the huge premium over yellows attracts a relatively larger share of area. This sets up for green pea production to possibly be the highest in five years, depending on yields, potentially putting pressure on prices.

Lentil Acreage Increase Limited Despite High Prices

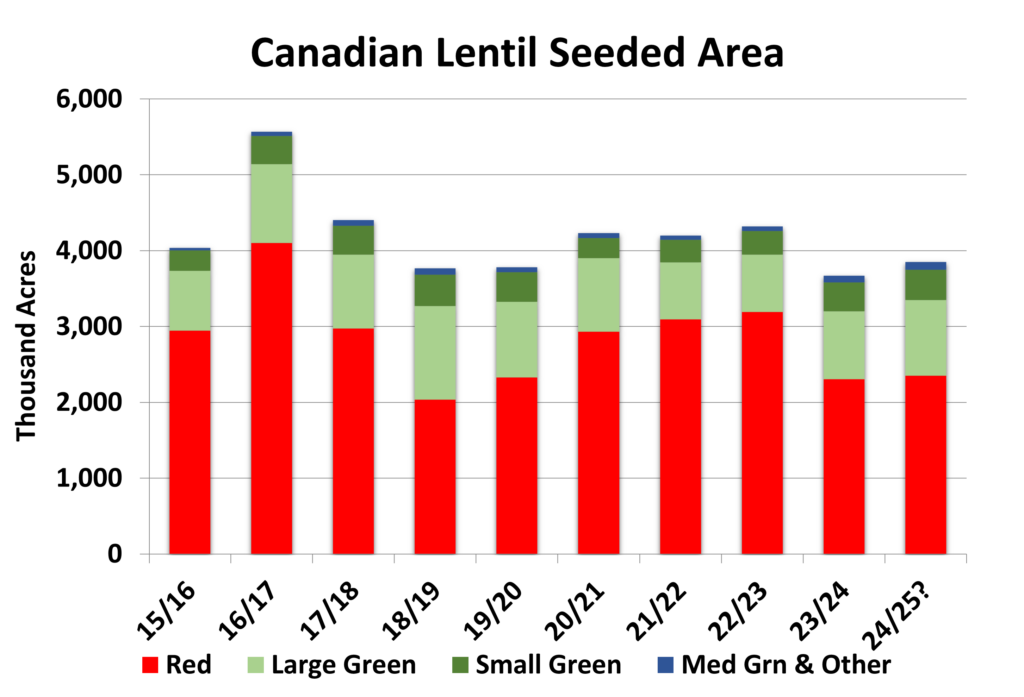

Robust exports through the first half of the marketing year are drawing lentil stocks lower and supporting prices. This is particularly the case for large and small green lentils, where importers have few alternatives as Canada and the United States (U.S.) are the primary source of global supplies. This has pushed prices to record levels. Red lentil prices have largely stayed within a range as importers have access to supplies from other countries, such as Australia, although local bids are still at a fairly good level historically.

Strong prices will encourage larger Canadian plantings in 2024, potentially by around 5%. The price incentive might suggest an even larger increase, but seed availability and agronomic concerns limit the gains. Higher area will largely come from green lentils, which could see an increase of over 10%, creating the potential for the kind of build in supply that pressures prices in 2024/25.

Red lentil area may only see a modest increase in plantings, although an improvement in yields would allow for a bump in supply. The fact the old crop carry-in will be very low for both red and green lentils means the market will be very sensitive to weather. Conditions in other production regions will be important as well, including key import markets such as India and Turkey, as well as export competitors, like Australia.

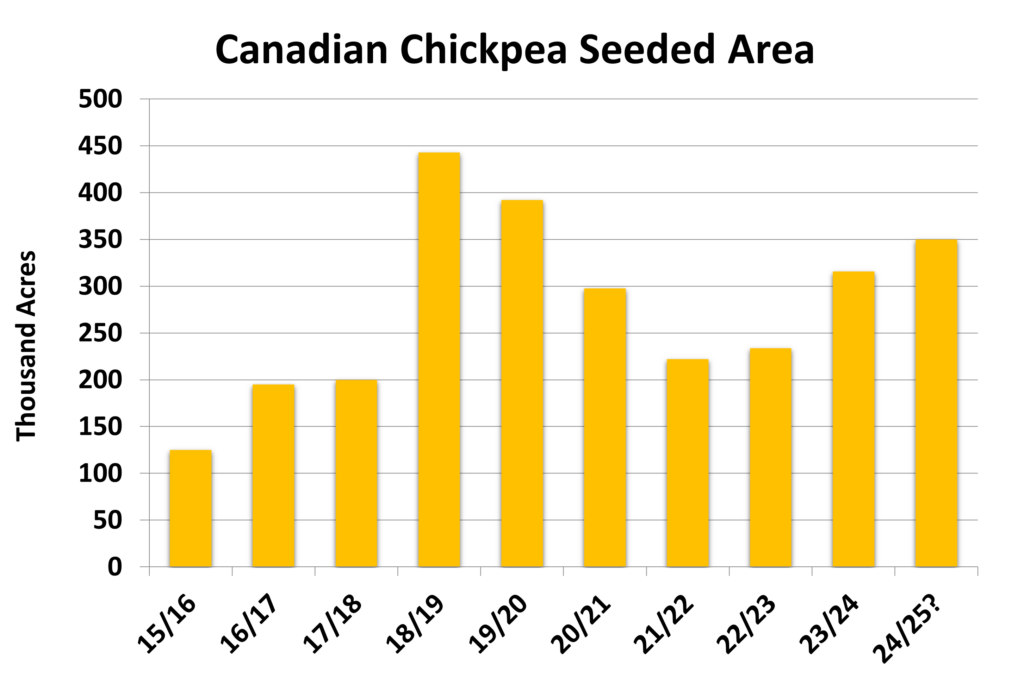

Chickpea Outlook Driven By Crops in Other Regions

A small old crop carry-in and another year of low yields left Canadian chickpea supplies at their smallest since 2017/18, despite the higher seeded area in 2023 (although actual supplies could be larger than what the official data is showing). Strong early season exports have further drawn down stocks, forcing a sharp slowdown in movement through the balance of the year. While domestic prices have not kept pace with gains seen in some other overseas markets, values remain relatively strong. This will trigger the fourth consecutive year of larger chickpea plantings, possibly to the highest since 2019. Even so, supplies will remain on the lower end of recent history. In the meantime, there is the potential for smaller crops in Mexico and India, which could keep global markets well supported.